Invest in Commercial Real Estate

Explore our current investment offerings, assets under management & development, and successfully exited assets.

Need assistance? Our dedicated team is here to assist you. Schedule a meeting today, and we'll provide personalized insights into each opportunity.

Current offerings

Investment Type

Investment Strategy

Objective

Targeted Hold Period

Minimum Investment

Investment Type

Investment Strategy

Objective

Targeted Hold Period

Minimum Investment

Investment Type

Investment Strategy

Objective

Targeted Hold Period

Minimum Investment

Investment Type

Investment Strategy

Objective

Targeted Hold Period

Minimum Investment

Investment Type

Investment Strategy

Objective

Targeted Hold Period

Minimum Investment

Investment Type

Investment Strategy

Objective

Targeted Hold Period

Minimum Investment

Meet the team

Jon Pettit

SVP of Fund Management

Elaine Beeson

Director of Investments

Conor Donohue

Vice President of Wealth Development

Brion Cum

Vice President of Wealth Development

Ted Aust

Vice President of Wealth Development

Dimitri Uhlik

Vice President of Wealth Development

Dereck Grey

Vice President of Wealth Development

Michael Stanek

Associtate VP of Wealth Development

Preston Nafus

Investor Services Manager

Mikayla Guerrero

Investor Services Representative

Elliot Galey

Investor Services Representative

Schedule A Call With Our Wealth Development Team

Assets Under Management / Development

Hospitality

Doubletree Tucson

Tucson, AZ

Crowne Plaza

Phoenix, AZ

Hampton Inn & Suites

Scottsdale, AZ

Holiday Inn Chandler

Chandler, AZ

Holiday Inn Phoenix

Phoenix, AZ

Hilton Tucson East

Tucson, AZ

Hilton Phoenix Airport

Phoenix, AZ

Salmon Falls Resort

Ketchikan, AK

The Ketch

Ketchikan, AK

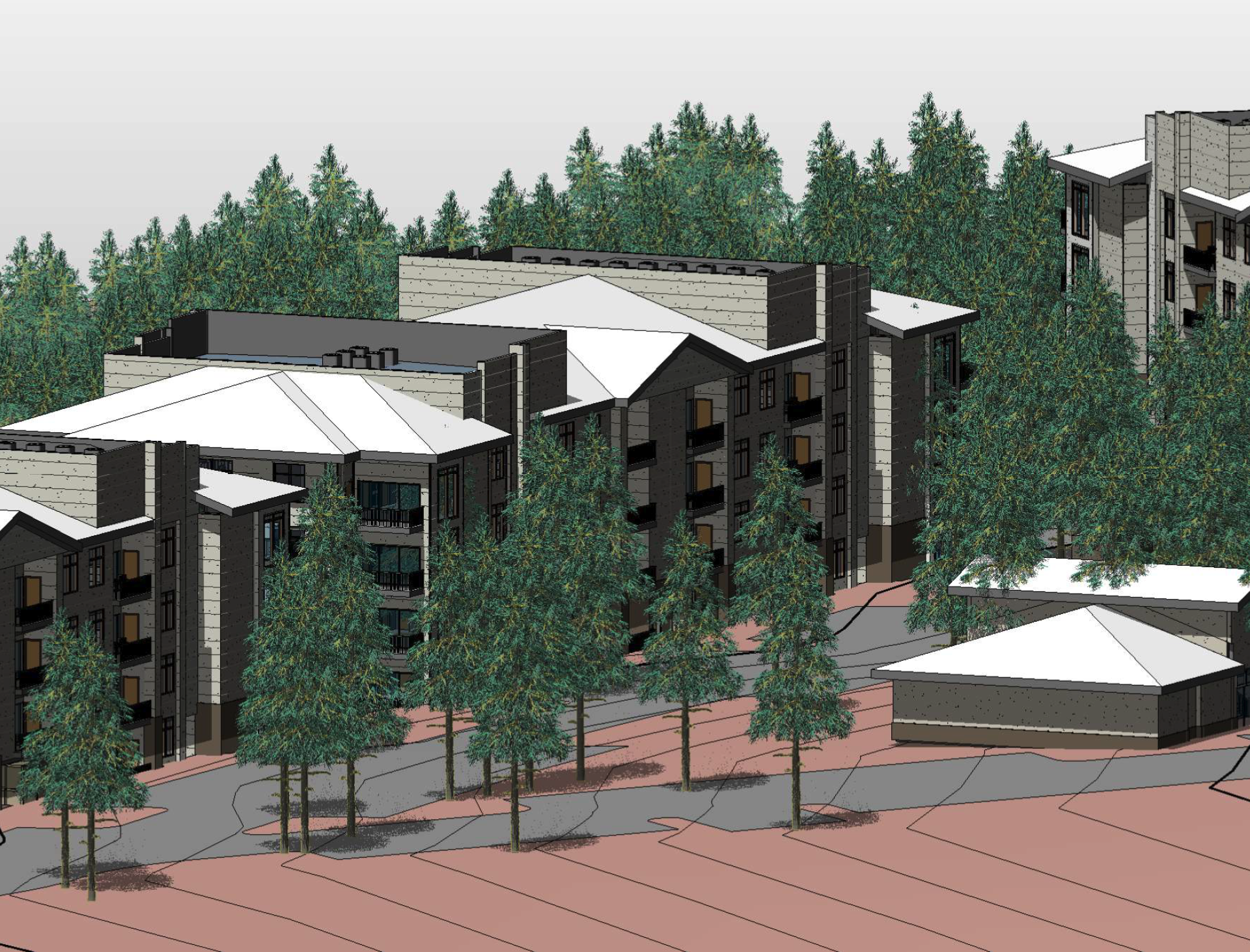

Multi-family

Eclipse Townhomes

Scottsdale, AZ

Jordan Lofts

Bryan, TX

Roosevelt Townhomes

Tempe, AZ

Second Avenue Commons

Mesa, AZ

SouthPointe Apartments*

Ahwatukee Foothills, AZ

West Frontier Apartments

Payson, AZ

Lorca Apartments

Bryan, TX

MEDICAL OFFICE / HOSPITAL

Dallas-Fort Worth Behavioral Health Hospital

Phoenix, AZ

Phoenix Medical Psychiatric Hospital

Phoenix, AZ

Office

305 E. Main

Mesa, AZ

Scottsdale Gateway II

Scottsdale, AZ

LAND

Encore

Johnstown, CO

North Ridge Johnstown

Johnstown, CO

The Ridge Johnstown

Johnstown, CO

The Trails at Saddleback Ranch

Wickenburg, AZ

Riverwalk Developments

Scottsdale, AZ

Blue Spruce Ridge

Johnstown, CO

West Ridge

Johnstown, CO

Other commercial properties

Mesa Portfolio

Mesa, AZ

Pima Center

Scottsdale, AZ

PURE Pickleball & Padel at Riverwalk

Scottsdale, AZ

SOLD / EXCHANGED PROPERTIES

Sold May 2024

VIP Self-Storage

Casa Grande, AZ

Sold Oct 2023

Northsight Crossing Retail Center

Scottsdale, AZ

Exchanged Jan 2023

Athol Self-Storage

Henderson, NV

Exchanged Jan 2023

Logan Self-Storage

Logan, UT

Sold Mar 2022

GC Square

Apartments

Phoenix, AZ

Sold Dec 2021

The Elkwood Apartment Homes Land

Flagstaff, AZ

Sold June 2021

Fiesta Tech

Gilbert, AZ

Sold Feb 2021

Treehouse Apartments

Tucson, AZ

Sold Dec 2020

Kingman Self-Storage

Kingman, AZ

Sold Dec 2019

The Palms

Phoenix, AZ

Sold Feb 2019

South Mountain Square Apartments

Phoenix, AZ

Sold Mar 2015

Scottsdale Commons Apartments

Scottsdale, AZ

To request a full list of Caliber cycled assets contact your Caliber Representative or call 480.295.7600

669-CAL-062424