Featuring

Our Competitive Advantage

Caliber is a leading financial services company in the alternative asset management space, focused on commercial real estate, providing accredited investors and registered investment advisors with well-structured alternatives to traditional investments.

Middle Market Fundraising & Capital Deployment

We invest in middle-market assets and geographies, applying established institutional private asset investment models, to deliver outsized returns.

Vertically Integrated Operating Model

Our investment service model produces improved visibility and control, enhanced investment returns, and robust off-market deal flow.

Growth Markets Geographic Focus

We focus on cities and regions with growing populations that are business friendly, with favorable taxes, entitlements, and access to local governments.

Non-Correlated Investment Solutions To Defend Against Inflation and Volatility

Historically, investing in real estate as been proven to hold value in any economic climate. It can be used to deliver a predictable income and/or to generate large, long-term returns for the investor. If the economy is unstable and inflation issues arise, investing in real estate assets or funds can be a great solution to diversify and protect your portfolio from the fallout.

Forged In Distress Born of the Financial Crisis

Caliber was founded in 2009, from the heart of the financial crisis, acquiring distressed assets.

We identified a unique advantage, in the underserved middle market. Our purpose-built investments are asset agnostic for the highest and best use, driving multiple avenues for growth with a cycle-tested team with deep industry experience and local relationships for proprietary off-market deal flow. As economics change we continue to seek out market appropriate solutions.

Caliber's Track Record

of Growth

2.9B+ Assets Under Management & Assets Under Development*

$667M+ Equity Raised

16-year History of Operations Cycle Tested

Caliber fund and asset investment offerings

We offer a range of investment offerings across Core, Core Plus, Value-Add and Opportunistic philosophies, meaning that you can typically find funds or assets that offer growth, income or a hybrid of both through us.

- Commercial real estate

- Qualified Opportunity Zones (QOZ)

- Private equity

- Debt facilities

Achieve generational wealth. Rise up with us.

Investment Solutions for financial professionals, institutions and accredited individual investors looking to strengthen portfolio diversification, hedge against inflation and reduce volatility using commercial real estate assets, funds and alternative investments.

Individual Investors

Diversify your portfolio by investing in funds and assets that offer outsized tax benefits, capital growth, income accrual or a hybrid of both.

Financial Professionals

For your clients seeking to enhance portfolio diversification, we offer numerous funds and asset types that build growth, accrue income or a hybrid of both.

Institutions

Provide value to your stakeholders by investing in funds and assets that offer atypical tax benefits, capital growth, accrue income or a hybrid of both.

The Middle Market - An Intersection of Meaningful Opportunities

Middle-market, private equity investing typically refers to the acquisition, financing, and management of commercial properties typically valued between $10 million and $500 million. This investment type lets investors pool their capital together and invest in an array of property classes.

Middle Market Investors

- High net worth (HNW)

- Underserved, high growth demographic

- Seeking alternative direct investments

Middle Market Geographies

- Strong demographics

- Historically higher cap rates*

- Financing gap (overlooked by larger firms)

- Opportunity Zones

Middle Market Assets

- $5m-$50m

- Fragmented

- Large deal volume

- Less competition from institutions

Past performance is not indicative of future results.

4 Investment Strategies

Core, core plus, value-add, and opportunistic are four different types of commercial real estate investing strategies. Each of these strategies carries its own set of risks and rewards, and investors may choose to use a combination of these strategies in order to diversify their investment portfolio.

CORE

The most conservative blend of risk and return.Property tends to be well-built in a great location with little deferred maintenance requirements and high-quality tenants already in place on long-term leases.

CORE PLUS

Properties with a good – not great – location, stable income, high quality tenants, slightly dated finishes, low to moderate vacancy rates.Properties provide an opportunity to create value by reducing risk, improving cash flow, or both through overcoming whatever challenges prevented the asset from being characterized as Core.

VALUE ADD

The goal with value-add is to find properties priced below the market that needs some work to restore their value.Commonly, value-add properties have little to no cash flow at acquisition. Fair to good location, dated finishes, medium to high vacancy levels, and some amount of deferred maintenance that must be addressed.

OPPORTUNISTIC

The opportunistic category is a little like investing in small-cap stocks.There’s greater risk buying less-established companies, however, the upside can be significantly higher than buying mature large-cap stocks. Can include developing something from scratch (ground-up development), repurposing a building from one use to another (adaptive reuse), and winning entitlements for raw land.

Investment Thesis

Each Caliber investment undergoes a multi-step underwriting process that begins with an in-depth review of past industry performance and current market conditions.

Opportunities are then assessed by our expert team to ensure that the investment aligns with our principles, which are applied to every deal, every time.

Meet the Team

Caliber is a leading vertically integrated asset management firm whose primary goal is to enhance the wealth of investors seeking to make investments in middle-market assets. We strive to build wealth for our investor clients by creating, managing, and servicing proprietary products, including middle-market investment funds, private syndications, and direct investments.

Recent Blog Posts, News & Webinars

Caliber’s Chris Loeffler in Forbes: Record Token Failures In 2025 Reinforce The Role Of Utility

Caliber CEO Chris Loeffler was recently quoted in Forbes in a piece examining the landscape of digital asset performance in 2025 and the growing emphasis on utility and sustainable infrastructure…

Real Estate & Digital Assets – Insights from Caliber CEO on 2026

Caliber Shareholder and Partners, 2025 was an eventful year, and I am writing to you to share some of my thoughts on the year and my outlook for 2026. I…

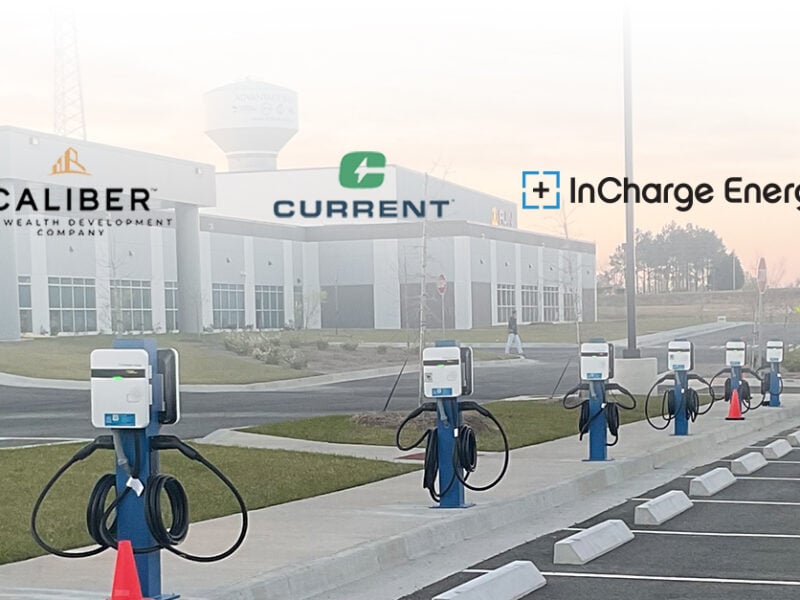

Current Powers Commercial Real Estate and Rideshare Growth at Caliber Properties by Expanding Access to InCharge Energy Electric Vehicle (EV) Charging Infrastructure and Charger Service Solutions

Caliber Drives Forward Asset Performance with Innovation SCOTTSDALE, AZ, October 7, 2025 – Caliber (Nasdaq: CWD), a diversified alternative real estate and digital asset platform, today announced a partnership to…

CALIBER PROFILED IN THE FOLLOWING PUBLICATIONS:

Book an investor strategy call with the Caliber Wealth Development Team

Disclaimers

INVESTMENTS IN PRIVATE PLACEMENTS CAN LOSE THEIR ENTIRE VALUE, ARE ILLIQUID AND ARE SPECULATIVE.

REFER TO THE AMENDED AND RESTATED PRIVATE PLACEMENT MEMORANDUM (PPM) FOR MORE DETAILED DISCUSSION OF RISK FACTORS.

631-CAL-031124