If you’ve been investing for a while, you’re likely comfortable with how to evaluate stock or bond investments for your portfolio. An investment in the ‘large-cap growth’ style box tells you something about the fund’s portfolio, the expected return, and the potential risks. You can get a snapshot of what you may be getting into with that information alone. But what about real estate investments? Is there such thing as a ‘large-cap office building’ or a ‘high-yield warehouse?’

Fortunately, there is (though it’s not exactly synonymous). Real estate investments fall into four broad categories: core, core plus, value-add, and opportunistic. While the definition may vary from sponsor to sponsor, these four broad buckets do a good job communicating the expected risk and return profile.

Before we talk about each category, let’s quickly cover what we mean by ‘risk’ in the context of real estate. Real estate risk generally comes down to two factors: the property’s physical attributes, and perhaps most importantly, how much debt the property is carrying.

Physical attributes include the condition and location of the property, the length and terms of in-place leases, and the creditworthiness of the tenants. Unless you’re transacting land, you need tenants in the building to pay enough rent to recoup the investment.

Debt is the other risk factor. Properties with more debt tend to be more sensitive to economic conditions (particularly changes to underlying interest rates). That’s because, like a simple lever, debt tends to magnify results – good or bad. That’s why the term ‘leverage’ is synonymous with debt in the context of real estate investing.

Leverage is always part of commercial real estate investing. Done well, a sponsor can add a lot of value by prudently using leverage throughout the project’s life, whether that’s by locking in competitive terms upfront or restructuring the property’s loan to make it more attractive to potential buyers.

That’s the risk side of these categories. The other side is the return, which is measured a few ways. Generally, we express real estate returns through cash-on-cash return, internal rate of return (IRR), and equity multiple. These three metrics can give you an idea of the shape of the return profile for a given property when taken together. We discussed each metric, including the benefits and limitations of each, in another article.

Click here to learn more about IRR, Equity Multiples and Cash-on-Cash Returns in real estate investing.

Let’s use IRR for returns. IRR measures the profitability of an investment over the project’s life, making it more descriptive than cash-on-cash or equity multiple, neither of which account for the time value of money.

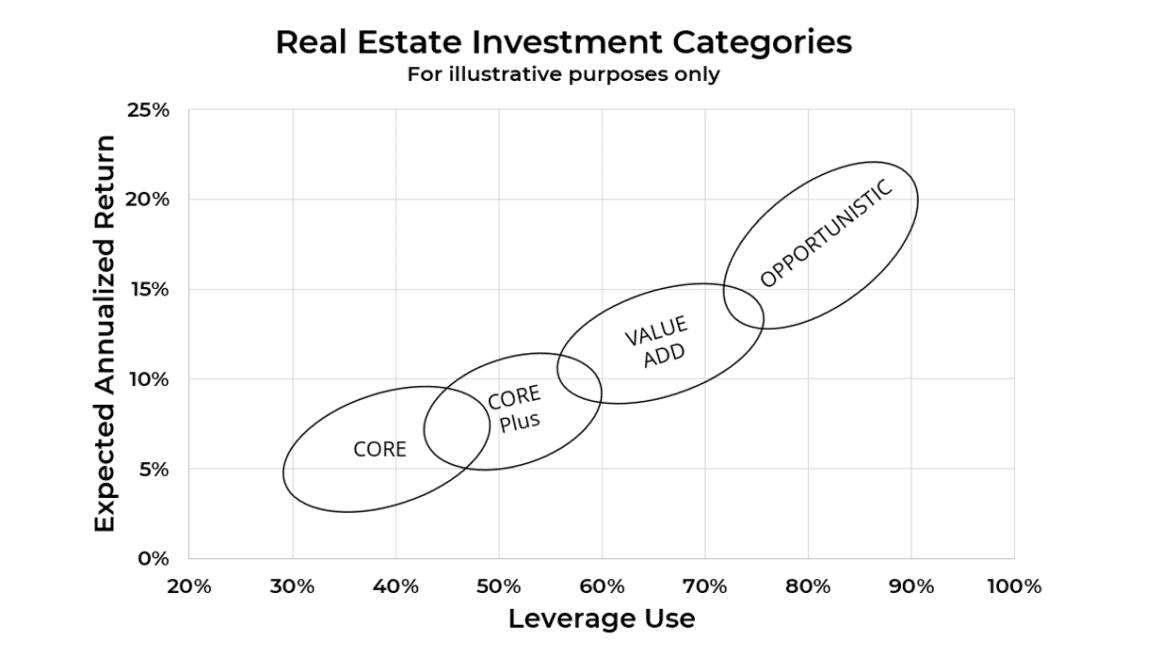

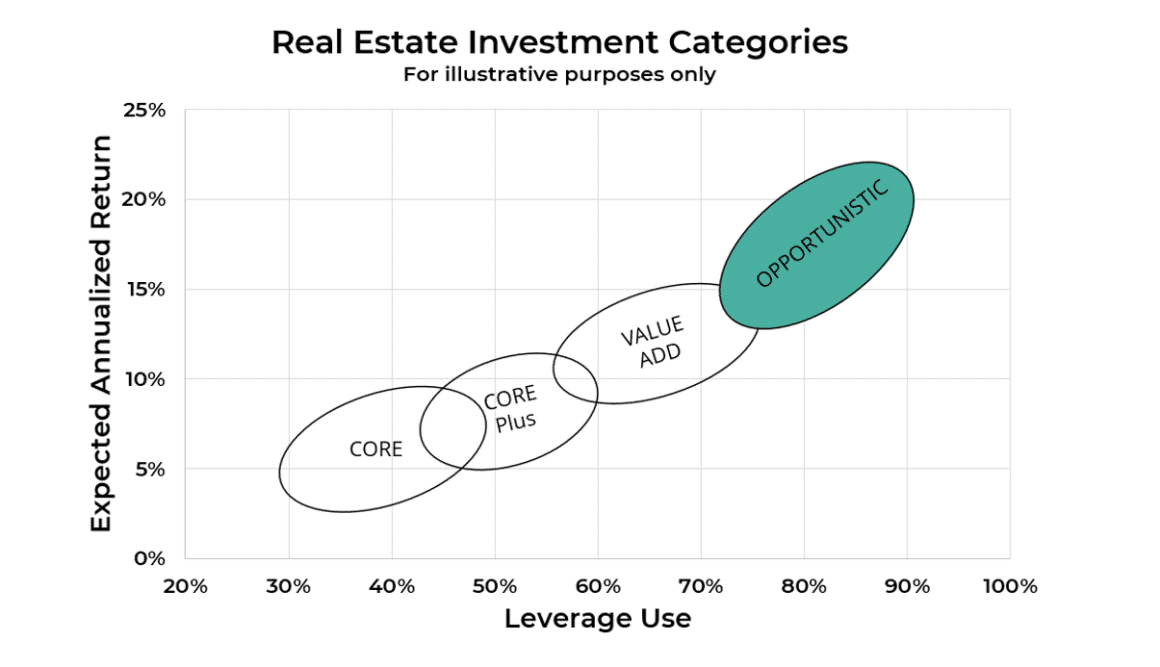

Let’s map the four categories according to return (y-axis) and risk (leverage use) (x-axis):

Join Chris Loeffler, Caliber CEO, as he shares Caliber’s journey from a small startup to a market leader in commercial real estate asset management and gives key insights on Caliber’s innovative investment approach, including self-directed IRAs and private loans.

There are various approaches utilized by Caliber, such as converting commercial spaces, investing in distressed real estate, and introducing pickleball facilities. In this podcast, Chris discusses the importance and intricacies of approaching opportunity, building investor trust, securing funding, transitioning to the public domain, and maximizing returns within Opportunity Zones.

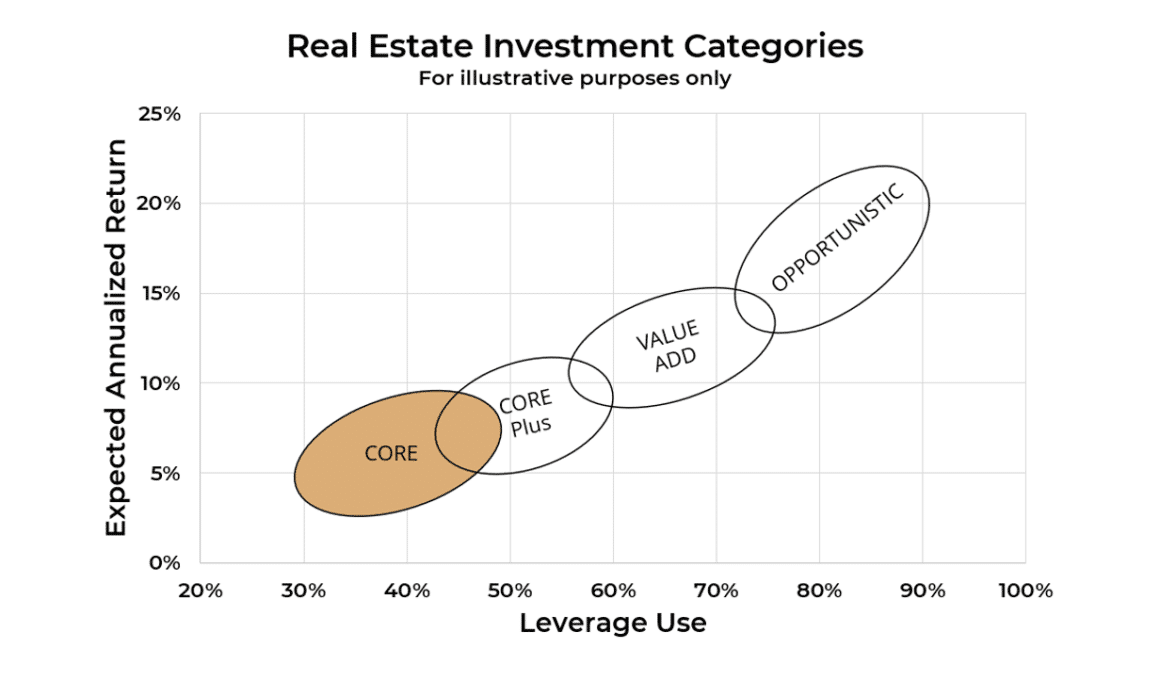

Core Real Estate Investments

Core real estate investments represent the most conservative blend of risk and return. Like a bond, current income represents the bulk of the return. That’s because the property tends to be well-built in a great location with little deferred maintenance requirements and high-quality tenants already in place on long-term leases. When you invest in core properties, you’re investing to access a portion of the property’s cash flow right now.

It’s not unreasonable to expect to achieve between a 7% and 10%* annualized return from a core property, with 0-40%** leverage used in the property’s capitalization.

Given that profile – 7% to 10%* returns with little risk – you might be asking why anyone would consider investing elsewhere. The catch with core properties is that you don’t see a lot of appreciation, making them less suitable for investors seeking growth or growth and income. Core investments attract institutional investors – deep-pocketed endowments or insurance companies – who tend to snap up these properties for their portfolios, which can quickly increase prices and make it hard to find any below-market deals. In other words, you tend to buy high and sell high on core properties.

Lastly, remember that physical attributes and debt determine a property’s risk profile. An otherwise core asset that fits the description above with 70%* leverage or more no longer fits the core category.

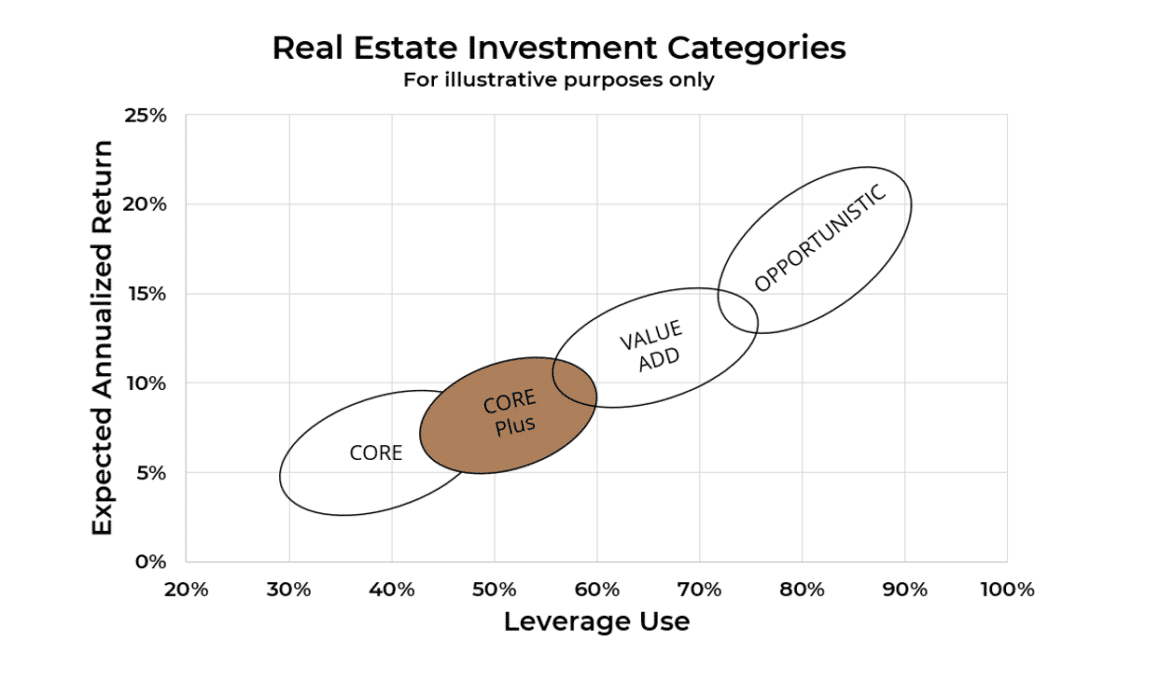

Core Plus Real Estate Investments

Core plus real estate investments are very similar to core properties, but for one reason or another, they don’t quite fit into the most conservative category. Whatever the reason, remember that the big institutional investors are looking for high-quality cash-flowing properties with little risk. That means core-plus properties provide an opportunity to create value by reducing risk, improving cash flow, or both to attract these big buyers.

Consider a hotel in a great part of town that’s been there for years. While the furniture, fixtures, and equipment need updating and the parking lot needs to be resurfaced, physically, the rest of the building is in great shape. While financing these improvements may increase the leverage used in the deal, there’s now a better chance to attract guests at higher nightly rates than before, which, in turn, increases cash flow.

Given the modestly riskier investment profile, core plus investors can expect to achieve between 8% to 12%* annualized returns, with leverage use topping out around 0-40%+**, or so. If done correctly, core and core-plus investing should be straightforward and, frankly, the best kind of boring.

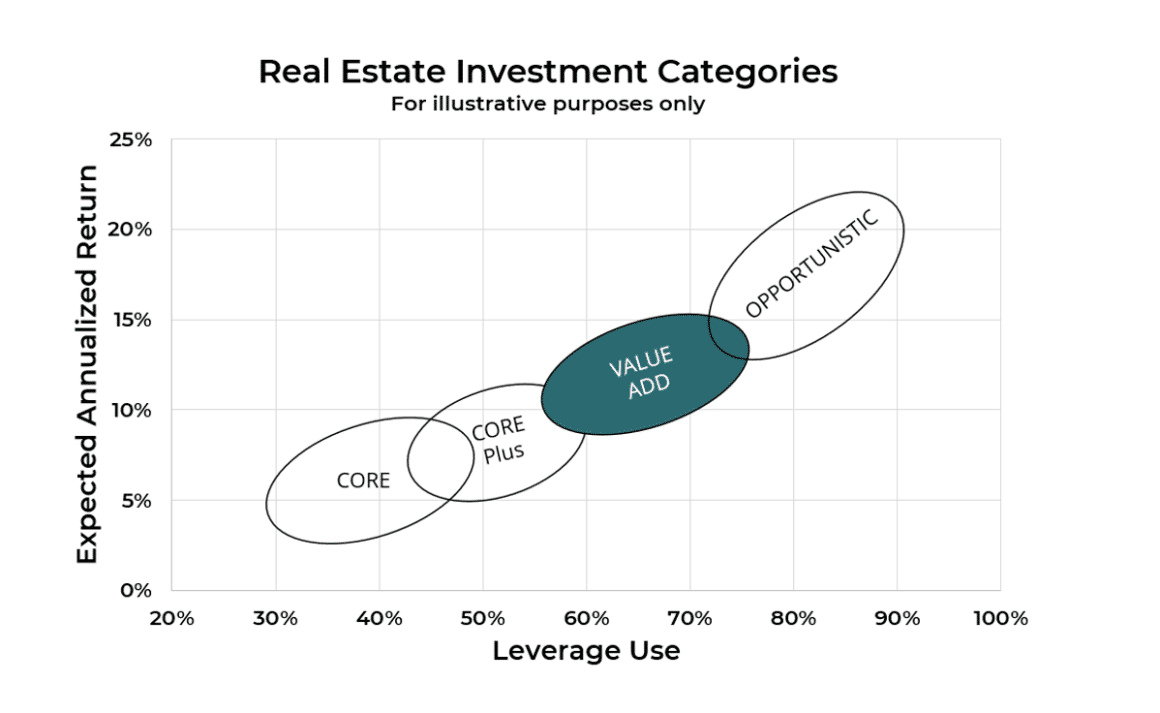

Value-Add Real Estate Investments

Things get more interesting in the value-add category. As the name implies, the goal with value-add is to find properties priced below the market that needs some work to restore their value. In many cases, an attractive property for the value-add category features strong fundamentals that need some changes to restore cash flow. Commonly, value-add properties have little to no cash flow at acquisition. We discussed the value-add development strategy in-depth on our site.

Those changes tend to be physical, operational, and/or structural. Physical changes mean the property’s physical characteristics need to be improved. Operational changes mean addressing issues with the property management team, specifically related to the property’s financial performance. Structural changes refer to the organization of the property. The property itself may be physically outstanding, but the organization underpinning it could present opportunities.

Given the modestly riskier investment profile, value-add investors can expect to achieve between 10% to 16%* or higher annualized returns, depending on the project. The changes needed to restore cash flow typically mean leverage use sits between 50% and 70%**.

Opportunistic Real Estate Investments

The opportunistic category is a little like investing in small-cap stocks. There’s greater risk buying less-established companies, however, the upside can be significantly higher than buying mature large-cap stocks. Do it right, and you may have a winner on your hands that more than compensates you for the additional risk.

Opportunistic projects can include developing something from scratch (ground-up development), repurposing a building from one use to another (adaptive reuse), and winning entitlements for raw land. Given the work and time required to take on these projects, expect to see a high degree of leverage used – 70% or more**. We discussed the new development strategy in-depth on our site.

For these risks, investors are compensated with significant returns. It’s reasonable to expect 20%* annualized returns or more investing in a successful opportunistic project. However, the multiples may fluctuate depending on the length of time of the holding period. Remember, investing in opportunistic offerings are the riskiest investment type of these categories. Please, ensure you’ve performed due diligence on any company you’re willing to give money to, as well as audit your portfolio appetite for a long-term investment commitment.

Hybrid Strategies and Opportunity Zone Real Estate Investments

In addition to the four broad strategies outlined above, real estate investments can combine elements of the strategies in various ways, resulting in a “hybrid” risk-reward profile. We could even say core plus strategies are a type of hybrid: They combine core assets with a bit more debt and perhaps require some renovations—thus creating a blend of the traditional core and value-add strategies.

Hybrid strategies are designed to optimize investor outcomes in terms of cash flow, upside, and risk management.

Opportunity zone investments often deploy hybrid investment strategies, so let’s take a closer look at how they work.

First, what are opportunity zone investments? The 2017 Tax Cuts and Jobs Act established the Qualified Opportunity Zone program, an initiative designed to lift Americans out of poverty and revitalize struggling areas. The program spurs economic development and job creation in more than 8,700 census tracts by offering preferential tax treatment to those investing certain eligible capital gains into Opportunity Zones through Qualified Opportunity Funds.

The IRS requires Qualified Opportunity Funds to pursue heavy renovations, adaptive reuse, or ground-up construction—all of which are value-add or opportunistic real estate investing strategies. Of the four categories, these are the riskiest, but they also offer the highest upside potential and highest rate of targeted return.

Here’s where the hybrid element comes into play:

Many Qualified Opportunity Fund sponsors (including Caliber) combine a value-add or opportunistic strategy with a core level of debt by borrowing 50% or less against the value of the assets. These funds combine the lowest level of debt risk (core) with the highest level of execution risk (value-add and opportunistic), creating a blended rate of return that offers investors an attractive upside without putting their capital at a high level of risk.

Let’s consider an example: One common hybrid opportunity zone strategy is known as “development to core.” The sponsor builds an asset from scratch, stabilizes the property, then holds it for cash flow—all within the same Qualified Opportunity Fund. This strategy is intended to deliver significant appreciation in the first three to five years, then become a consistent income-producing investment in its final few years. And because this strategy is implemented within a Qualified Opportunity Fund, investors can capture tax savings—a powerful benefit, given the detrimental effect taxes can have on a portfolio’s total return.

Diversification Across Different Real Estate Investment Strategies

We can also think about real estate investment strategies within the context of diversification. By spreading investments across multiple asset classes and types, diversification helps you reduce risk without diminishing returns. Diversification decreases volatility and mitigates losses from any one investment—meaning diversified portfolios are better positioned to handle the inevitable swings within the market than highly concentrated portfolios.

To achieve greater diversification, you may benefit from exposure to more than one type of real estate investment strategy. By holding investments that respond differently to a given market or economic stimulus, you can build real estate portfolios positioned to deliver better risk-adjusted returns.

Many seasoned investors apply this concept to US stocks. Instead of holding a portfolio consisting exclusively of small-cap tech stocks, for example, savvy investors aim to optimize their risk-adjusted returns by holding a diversified basket of US stocks featuring equities along the capitalization spectrum and stocks from different sectors, industries and styles.

Similarly, you can diversify your real estate exposure by building a portfolio with a range of investments from different categories, including different geographies, different asset types, and different strategies. If, for example, your only real estate exposure is to opportunistic office space, you could diversify by adding a core multifamily investment.

Real Estate Investment Strategies: A Springboard for Deeper Evaluation

Developing an understanding of the four broad real estate strategies—as well as hybrid or blended strategies—is a great way to conceptualize an investment’s risk and return profile, an important first step toward identifying whether an investment is a good fit for your individual goals. The categories provide a helpful snapshot of the investment’s characteristics, how it may fit into an existing portfolio, and its potential diversification benefits. Strategy categories are an excellent starting point to springboard into a deeper evaluation, which would include scrutiny of the sponsor’s approach, the property’s fundamentals, and the risks involved to realize the potential results. To see these strategies in action, please visit caliberco.com

Sources:

*The IRR numbers provided are determined using Investing in Real Estate Private Equity – An Insider’s Guide to Real Estate Partnerships, Funds, Joint Ventures and Crowdfunding; Prequin Quarterly: Real EstateQ3 2012

**The Loan to Value (LOV) numbers are determined using 2019 Real Estate Strategies Value-added strategies: global opportunities for the value approach

About Caliber

Caliber – the Wealth Development Company – is a middle-market alternative asset manager and fund sponsor with approximately $2 billion in assets under management and development. The Company sponsors private funds, private syndications, as well as externally-managed real estate investment trusts (REITs). It conducts substantially all business through CaliberCos, Inc., a vertically integrated asset manager delivering services which include capital formation and management, real estate development, construction management, acquisitions and sales. Caliber delivers a full suite of alternative investments to a $4 trillion market that includes high net worth, accredited and qualified investors, as well as family offices and smaller institutions. This strategy allows the Company to opportunistically compete in an evolving middle-market arena for alternative investments. Additional information can be found at CaliberCo.com and CaliberFunds.co.

Click here to see Caliber’s current property portfolio.

If you would like to speak to someone about diversifying your retirement accounts, contact us at [email protected] or call (480) 295-7600 to schedule a call with a member of our Wealth Development Team.

If you would like to learn more about Opportunity Zone Investing, Caliber has put together a special guide that cuts through the myths and misconceptions and outlines the benefits, the risks, and the upcoming deadlines you must know to be able to participate. Get access to the guide here.

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.

076-CAL-061522