Caliber – The Wealth Development Company recently completed renovations on a 62,596 square-foot mental health care facility in downtown Phoenix—a federally designated opportunity zone. Managed by Indiana-based NeuroPsychiatric Hospitals (NPH), Phoenix Medical Psychiatric Hospital (PMPH) is now open to the public and accepting patients.

Caliber acquired the once dilapidated property in August 2019 for $12 million with an adaptive reuse strategy. The building received an $11.3 million overhaul by the company’s in-house construction and development teams before opening its doors in October 2020. The newly modernized 96-bed facility was recently appraised at $28.4 million and features new patient care rooms and offices; upgraded public spaces and dining facilities; and an onsite pharmacy.

Join Chris Loeffler, Caliber CEO, as he shares Caliber’s journey from a small startup to a market leader in commercial real estate asset management and gives key insights on Caliber’s innovative investment approach, including self-directed IRAs and private loans.

There are various approaches utilized by Caliber, such as converting commercial spaces, investing in distressed real estate, and introducing pickleball facilities. In this podcast, Chris discusses the importance and intricacies of approaching opportunity, building investor trust, securing funding, transitioning to the public domain, and maximizing returns within Opportunity Zones.

The social impact: Phoenix Medical Psychiatric Hospital

Phoenix Medical Behavioral Hospital expects to serve nearly 4,500 patients each year, addressing a growing need for behavioral and psychiatric services in the area. In fact, the behavioral healthcare sector is growing exponentially and estimated to be a $18.7 billion industry as of 2020, with roughly 45 million people in the United States having diagnosable mental illnesses. The facility will also bring 80 high-income jobs to the area, fulfilling a key social impact objective for opportunity zone properties.

“This is very exciting,” says Chris Loeffler, CEO and cofounder of Caliber. “Not only will this provide needed services to a part of the country notorious for its shortage of in-patient neuropsychiatric hospital beds. It will also offer our accredited investors a strong annualized cash flow return and the chance to see their capital have meaningful impact on the community.”

Fast-Growing Submarket

Understanding the distinct Central Phoenix medical office submarket made the behavioral health hospital even more attractive to Caliber as an opportunity zone investment. Banner – University Medical Center Phoenix anchors the area’s seven major hospitals, which collectively support more than 10,000 social services workers. PMPH, which is located just across the street, will support the medical center by providing psychiatric care for Banner patients.

“This facility will help unclog hospitals not only of patients who have behavioral health issues but may also have some sort of comorbidity,” Loeffler says. “Not all of our nearby hospitals are designed to take care of both mental and medical health issues simultaneously. The business model at Phoenix Medical Psychiatric Hospital is designed to deal with both.”

Banner – University Medical Center Phoenix has experienced explosive growth in the last few years. The company recently added the 83,000-square-foot, three-story $33 million MD Anderson Cancer Treatment Center to its campus. Arizona State University also partnered with Wexford Science and Technology to create its Phoenix Biomedical Campus expected to open in Spring 2021. Valleywise Health Medical Center and St. Joseph’s Hospital and Medical Center are both within three miles of PMPH. All of these activities, framed by major highways (Interstate-10, State Highway 51 and Interstate-17), have created an elite medical hub and fast-growing submarket within Central Phoenix.

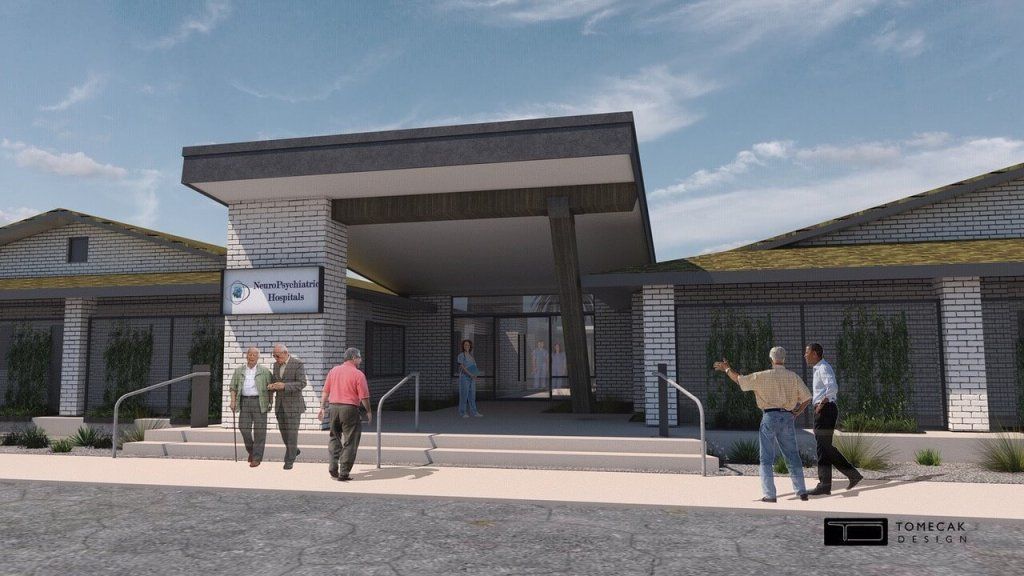

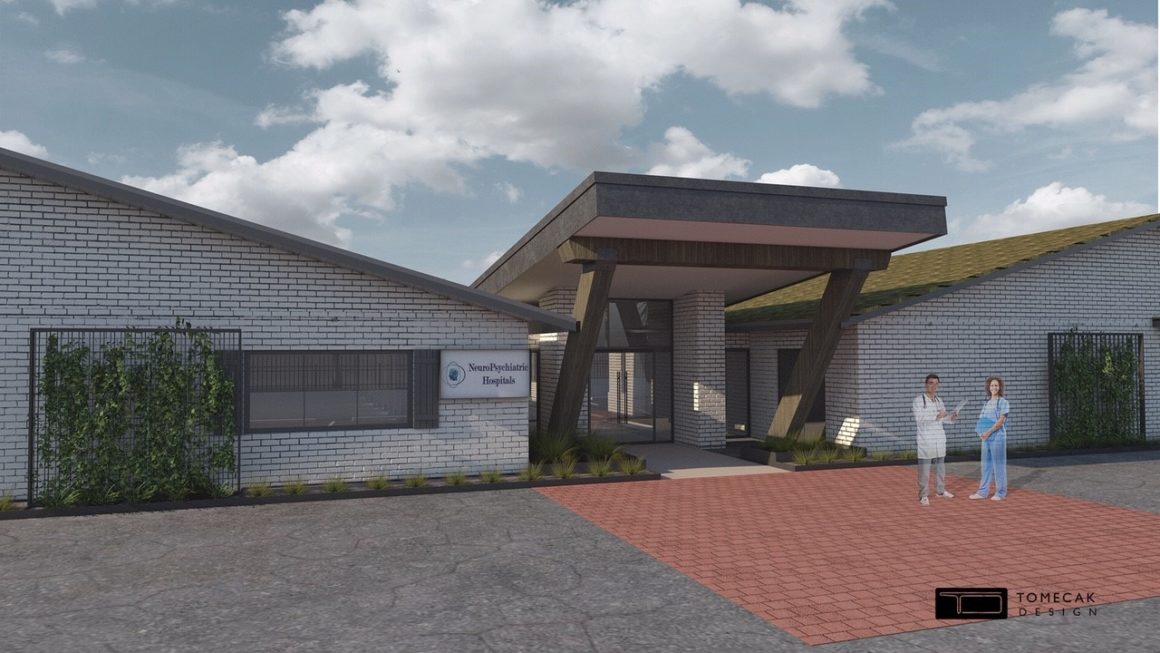

Unique Design

The renaissance of the Central Phoenix submarket continues to be one of the great real estate stories of the Southwest since the 2008 crash.

PMPH is adjacent to the area’s acclaimed Coronado Historic District, which is rich in architectural detail and character. The modest, single-story construction belies the large public spaces and soaring ceilings within PMPH. Twin inter-connected square buildings designed around open courtyards and a long open breezeway impart a subtle hacienda influence appropriate for the Sonoran Desert.

Investor Specs for Phoenix Medical Psychiatric Hospital

The facility will offer investors in Caliber’s opportunity zone investment a 20% internal rate of return over the 20-year lease.

Key metrics on the property include:

- $23 million cost basis

- $2.4 million annual net income

- 10.4% cap rate on cost

- $28.4 million recent appraised value

- Opportunity Zone Qualified

- 20% project IRR & 3.7x equity multiple (projected)

To learn more about Phoenix Medical Psychiatric Hospital as an opportunity zone investment, contact us.