Now may be an excellent time for investors to use current market conditions to their advantage and invest in real estate.

The real estate market cycles up and down due to a number of variables: interest rates, supply and demand, and investor sentiment. Through the end of 2019, interest rates and supply were historically low while demand remained high. In a survey of commercial real estate industry leaders, Deloitte found that 76% of respondents were very optimistic or somewhat optimistic about the commercial real estate industry’s performance over the next 18 months.

Fast forward to the end of 2020: the US has suffered through a pandemic, raging wildfires, flooding from multiple hurricanes, widespread social justice protests, and the potential for a contested presidential election. All of which begs the question: between interest rates, supply and demand, and investor sentiment, which of these three factors has materially changed?

(5/10/2021 – Update: The next big Opportunity Zone Fund deadline is June 30th.

Join Chris Loeffler, Caliber CEO, as he shares Caliber’s journey from a small startup to a market leader in commercial real estate asset management and gives key insights on Caliber’s innovative investment approach, including self-directed IRAs and private loans.

There are various approaches utilized by Caliber, such as converting commercial spaces, investing in distressed real estate, and introducing pickleball facilities. In this podcast, Chris discusses the importance and intricacies of approaching opportunity, building investor trust, securing funding, transitioning to the public domain, and maximizing returns within Opportunity Zones.

To be sure, bearish sentiment is warranted for some retail market segments that have failed to adapt to the rise of e-commerce. Hotels and office properties will need to adapt to the new normal, but the fundamental value proposition of either property category appears unchanged.

In short, the coronavirus-induced recession appears to be event-driven rather than a change in the underlying fundamentals. If anything, the shutdowns and shift to working from home created the opportunity to take advantage of temporarily mispriced assets.

Here are five reasons to consider investing in real estate right now:

1. Higher yield than bonds

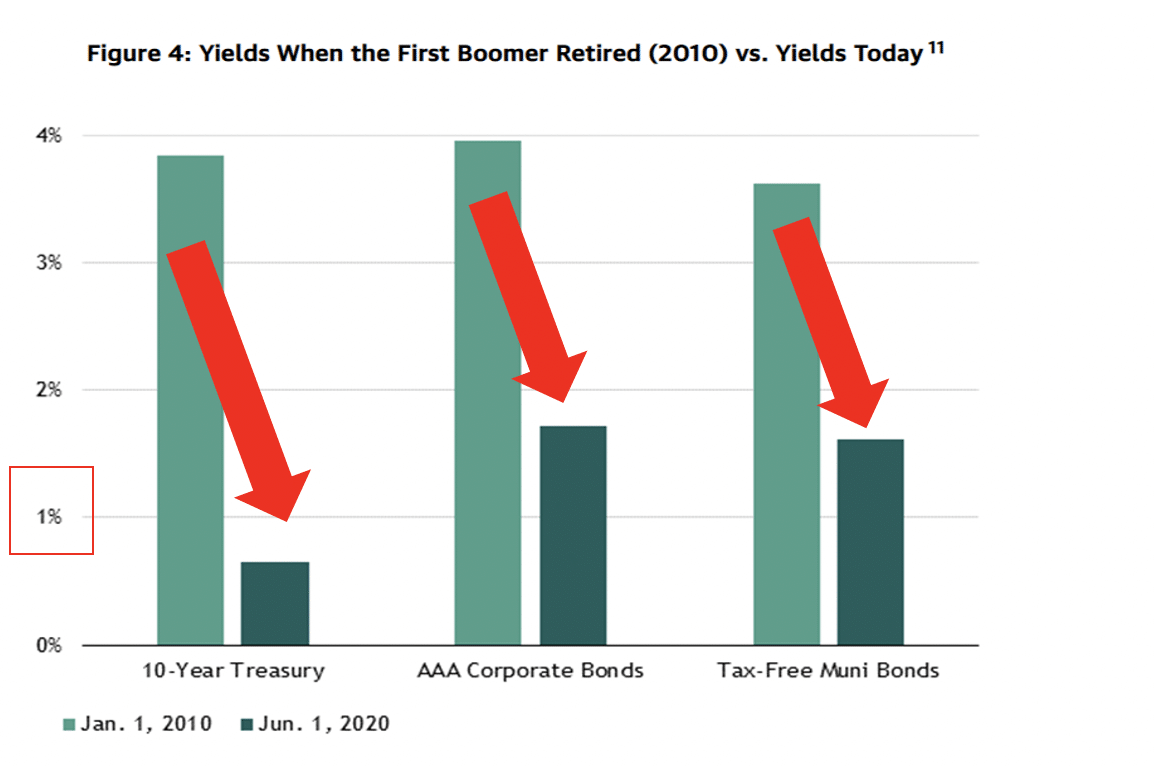

Historically low interest rates are a double-edged sword. While access to capital has never been cheaper, it also means bond yields are a fraction of what they have historically paid. Gone are the days of parking cash in a savings account to collect 5% risk-free interest. In a recent memo, Blackstone noted the impact of low yields on those of or approaching retirement age, comparing today’s yields to when baby boomers first started retiring in 2010. The contrast is stark.

Fed Chair Jerome Powell has stated that interest rates will reflect an “accommodative” stance for the foreseeable future. This does not bode well for bond yields. Record-low rates, higher inflation and typical capital gains taxation mean poor returns on bonds.

However stabilized, cash-flowing real estate could help compensate. Under normal circumstances, investors could reasonably expect a 6-8% yield derived from cashflow. But since coronavirus has depressed prices, you may be able to find a cash-flowing property at an attractive value to realize both the cashflow benefit and the potential price appreciation after the economy improves.

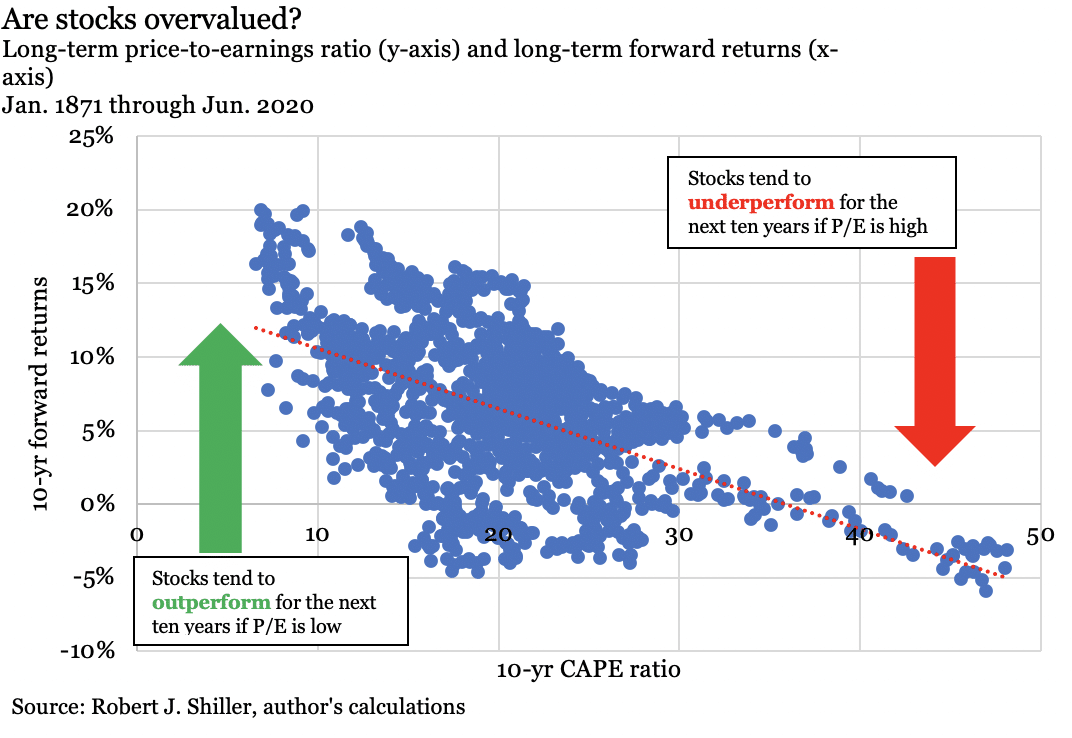

2. Higher potential growth than stocks

Just because something generates cashflow does not mean you should pay more to achieve those earnings. The ratio of price to earnings reflects the asset’s value and can be a useful metric to determine whether or not an investment is sound. Historically, when the price-to-earnings ratio for stocks exceeds 30:1, the forward returns for stocks tend to be flat or negative. As of June 30, 2020, US stocks’ long-term price-to-earnings ratio sits at 32:1, which suggests stocks are overvalued, and forward returns may be flat to negative.

Value-add or development real estate projects offer investors the potential to realize an attractive total return and generate cash flow along the way. Value-add deals are projects that seek to complete renovations to stabilize a property to charge higher rents. Opportunistic deals are typically development projects that can offer the highest risk in exchange for the potential for the highest return.

If you’re looking for growth opportunities and an alternative to the volatility of the stock market, consider shifting some assets to value-add or opportunistic real estate projects. Carefully consider your risk tolerance and liquidity needs before committing capital to invest in real estate.

3. potentially attractive prices

The pandemic had immediate and widespread impact on the commercial real estate industry. Property prices fell as businesses shut down and the economy halted. But given the relative strength in balance sheets, capital availability and liquidity, the coronavirus may have gifted investors a rare opportunity to pick up properties at below-market prices.

For example, consider offices. Though many employers have shifted to remote work, the move will not be permanent for some. JPMorgan Chase CEO Jaime Dimon expressed his desire to return employees to office work sooner rather than later, citing the potential for long-term damage and mental health issues due to alienation. Netflix CEO Reed Hastings echoed Dimon, calling long-term remote work a “pure negative.” He vowed to bring his employees back following a vaccine.

In short, investors can leverage current market conditions to invest in real estate asset classes that will recover and potentially thrive following the pandemic.

4. potential change in tax policy

Many candidates during an election year rely on ambitious policy goals that promise to reshape the country to win voters. In reality, signature legislative accomplishments are infrequent, and the impact is not always as expected.

Still, there remains a possibility that tax policy may change over the next four to eight years. Combined with the significant gains in the U.S. stock and real estate markets, now may be the right time to take some money off the table.

Opportunity zone funds may offer an exclusive combination of growth and tax efficiency. Under the Tax Cuts and Jobs Act of 2017, the IRS allows accredited investors to place qualified capital gains into opportunity zones. Opportunity zones are census tracts designated by the federal government to accept capital gains investment. In exchange, investors may defer, reduce or eliminate their capital gains liability over the next 10 years. If you are looking for a long-term growth-oriented investment that comes with significant tax advantages, opportunity zone funds may be the right investment for you.

Opportunity zone funds are a complex investment. Consult your tax and legal professional before committing capital to invest in real estate.

5. portfolio diversification

With stocks and bonds hitting historical extremes and real estate prices temporarily disrupted by the coronavirus, now may be a great time to consider diversifying your portfolio with commercial real estate.

If you are unsure which properties or locations to consider, a diversified fund of properties may be the better fit for you. Commercial real estate funds pool investor capital to build a portfolio of properties. Funds can be broad-based—seeking to purchase any attractively priced asset when it becomes available—or more specialized, focusing on hotels or offices, for example.

Funds relieve you of the burden of choosing the particulars of the deal. Once you choose your manager and commit capital, the manager will build the portfolio from there. Income and growth potential depend on the fund’s stated objective.

To invest in real estate and learn more about the Caliber Tax Advantaged Opportunity Zone Fund, LP; Caliber Diversified Opportunity Fund and offerings, contact us today.

11 Bloomberg, as of 6/1/20. Represents yields for generic 10-year US Treasury bonds, and yield to worst for the Bloomberg Barclays Aaa Corporate Total Return Index and the Bloomberg Barclays Municipal Bond Index.