Where can you invest capital gains after selling a business? The year a business is sold can result in a significant one-time tax outlay for former business owners. There are a few different ways a former business owner can invest their proceeds from the sale of a business in order to defer, and in some cases minimize, the tax bill that comes from selling a business.

For the various investment options below, the same set of facts will be used:

- Business owner sells their business for $2.5 million cash after owning it for more than 1 year.

- The long-term capital gain on the sale is $1.5 million.

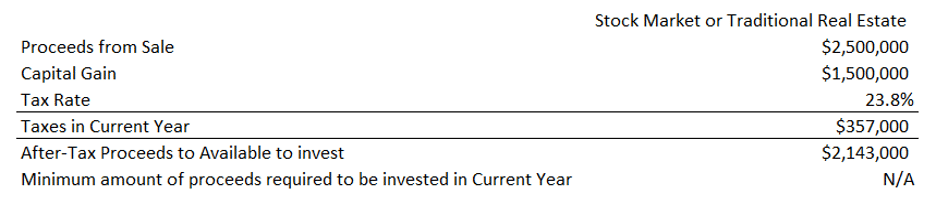

Where to invest Capital Gains after Selling a Business – Taxable Option

Stock Market or Traditional Real Estate Investments

If the business owner invests their capital gains in the stock market or traditional real estate investments, the Federal tax consequences in the current year would be as follows:

The business owner would owe $357,000 in Federal capital gains taxes and would have $2.143 million to invest.

Note, this calculation is assuming the current Federal tax rate for capital gains of 20% plus the additional 3.8% net investment income tax. Also, it does not factor in any potential state tax. President Joe Biden has expressed a desire to increase the Federal capital gain’s tax rate from 23.8% to 39.6% for individuals who make over $1 million in a year. In addition, if the net investment income tax continues to be applied to capital gains, the Federal tax rate could increase to 43.2%.

A link to President Biden’s proposed plan to increase the capital gain’s tax rate can be found here.

Where To Invest Capital Gains After Selling A Business – Tax-deferral Options

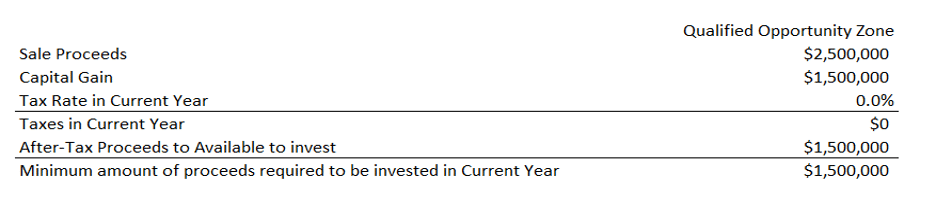

Option #1: Investing Capital Gains into Qualified Opportunity Zone Funds

The Qualified Opportunity Zone program was created in 2017 as part of the Tax Cuts and Jobs Act. The purpose of the program is to provide a tax incentive for investors to make long-term investments in economically distressed communities. See below for details on the program:

- The business owner only needs to invest capital gains into a Qualified Opportunity Zone Fund to defer capital gain recognition. From the example above, if the business owner invests $1.5 million, they would not need to recognize any capital gain income on their tax return in the current year.

- The investment must be made within 180 days after the close of the sale of the business.

- The investment can be made into real or personal property.

- If the business owner holds the asset for at least five years, they will receive a 10% step up in the basis of their investment amount. For example, they will only be required to recognize $1.35 million of taxable gain, instead of the original $1.5 million, when the tax is due on their 2026 income tax returns.

- No tax will be assessed on the growth in the value of the investment for the entire holding period if the investor holds the investment for at least 10 years. This is because the investment is stepped up to the current fair market value when the investment is sold.

The tax consequences of investing in a Qualified Opportunity Zone in the current year would be as follows:

The full $2.5 million does not need to be invested in order to receive the tax deferral, only all or a portion of the capital gain needs to be invested. The deferred capital gain will be triggered on December 31, 2026, and the taxpayer will owe the capital gain tax on their 2026 tax returns. Qualified Opportunity Zone Funds will try and make cash distributions out to its investors to cover this tax bill, but there is no guarantee a fund will be able to cover this tax payment.

A link to a summary of Qualified Opportunity Zones can be found here.

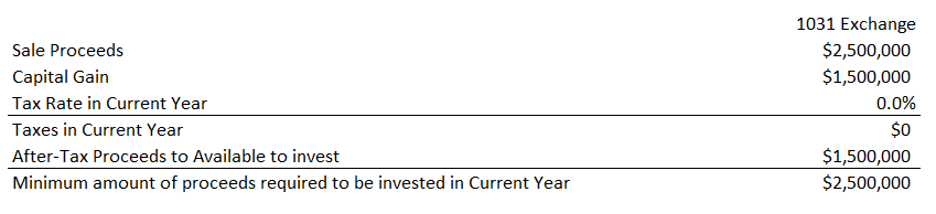

Option #2: Investing Capital Gains into 1031 Like-Kind Exchanges

The 2017 Tax Cuts and Jobs Act made significant changes to 1031 Exchanges. The most significant change is that like-kind exchanges can only be made using real estate. All personal property like franchise rights, machinery, vehicles, and patents or other intellectual property are no longer allowed to be used for 1031 exchanges.

Below are the requirements to create a valid 1031 Exchange:

- 100% of the proceeds from an investment must be re-invested to qualify for tax deferral. In the example above, all $2.5 million of proceeds will need to be invested in order to qualify.

- The business owner must identify real property for reinvestment within 45 days, and the transaction must be completed within 180 days after the sale of the business.

- There are no opportunities to receive a step up in basis in the newly acquired real estate.

- There are no opportunities to eliminate taxation on future growth in the new investment, unless another 1031 exchange is performed.

- Tax will be deferred until the newly acquired property is sold.

The tax consequences of performing a 1031 exchange in the current year would be as follows:

Note, President Biden has stated on several occasions he plans to completely remove this tax deferral mechanism.

An article discussing President Biden’s plan to repeal 1031 exchanges can be found here.

In Summary

- A business owner can choose to re-invest capital gains from the sale of a business to defer or minimize the recognition of income in the current year.

- If a business owner opts to invest in the stock market or traditional real estate investments, there will be no requirements on how much an owner must invest or how it is invested. However, this method of investment does not allow for tax deferral or tax minimization. Any capital gain from the sale of a business will be due in the year the sale occurred.

- An investment in a Qualified Opportunity Zone Fund will allow the business owner to defer and minimize their tax bill. The investor will only need to invest the capital gains portion of the sale of the business to qualify for both tax deferral and minimization.

- Another option to defer the recognition of capital gains is a like-kind exchange of real property. The requirements for a like-kind exchange include that all the proceeds from the sale are required to be re-invested, so there is not a possibility to take some cash out. Also, personal property is not eligible for a like-kind exchange.

Interested in reading more about Opportunity Zone Investing? View more articles below.

The IRS Has Again Extended the Deadlines for Investments in Qualified Opportunity Funds

Investing in an Opportunity Zone—The Power of Using Capital Gains to Defer Tax

QOZ Development Deal Overview: Phoenix Medical Psychiatric Hospital