Large university endowments—particularly Ivy League Funds—are among the most influential, closely watched institutional investors. As leaders in diversified multi-asset-class investing for more than two decades, these endowments enjoy a reputation for innovation and delivering attractive risk-adjusted returns.

Considered by many to be the epitome of “Smart Money,” elite endowments rely on sound asset allocation strategies to boost portfolio returns. They also benefit from access to exclusive, top-performing investment opportunities, and draw on a deep network of talented alumni to build their sophisticated investment committees.

What can individual investors learn from the university endowment playbook, specifically regarding asset allocation and real estate investments?

What is a university endowment?

University endowments are dedicated, permanent sources of funding for educational institutions. Their funds come from gifts, legacies and investment returns.

Endowment investment mandates are focused on:

- Providing a perpetual source of funds for the university, i.e., generating capital appreciation over a very long investment horizon

- Diversification

- Stable and strategic allocations; minimal focus on market timing

In general, university endowments target a real average annual return of 5% over a five- or ten-year horizon.

| Harvard’s endowment is a dedicated and permanent source of funding that maintains the teaching and research mission of the University. Established in 1974, Harvard Management Company invests these funds as a single entity, the revenue from which contributes more than one-third of the University’s annual operating budget. HMC’s generalist investment model breaks down silos among asset classes to search the world for the most attractive risk-adjusted returns. |

| The Endowments are managed as long-term investment funds with a time horizon exceeding that of most other investors. They have consistent sources of funding with relatively low and reasonably predictable short-term distribution requirements. As a result, the Endowments can assume significant equity risk as well as higher levels of liquidity than the typical investor. These two factors alone should typically produce higher long-term returns relative to most other funds. When combined with effective risk systems and risk management, attractive and consistent results have been achieved. In addition, other factors are key to creating superior risk-adjusted long-term returns. |

Who are the biggest players?

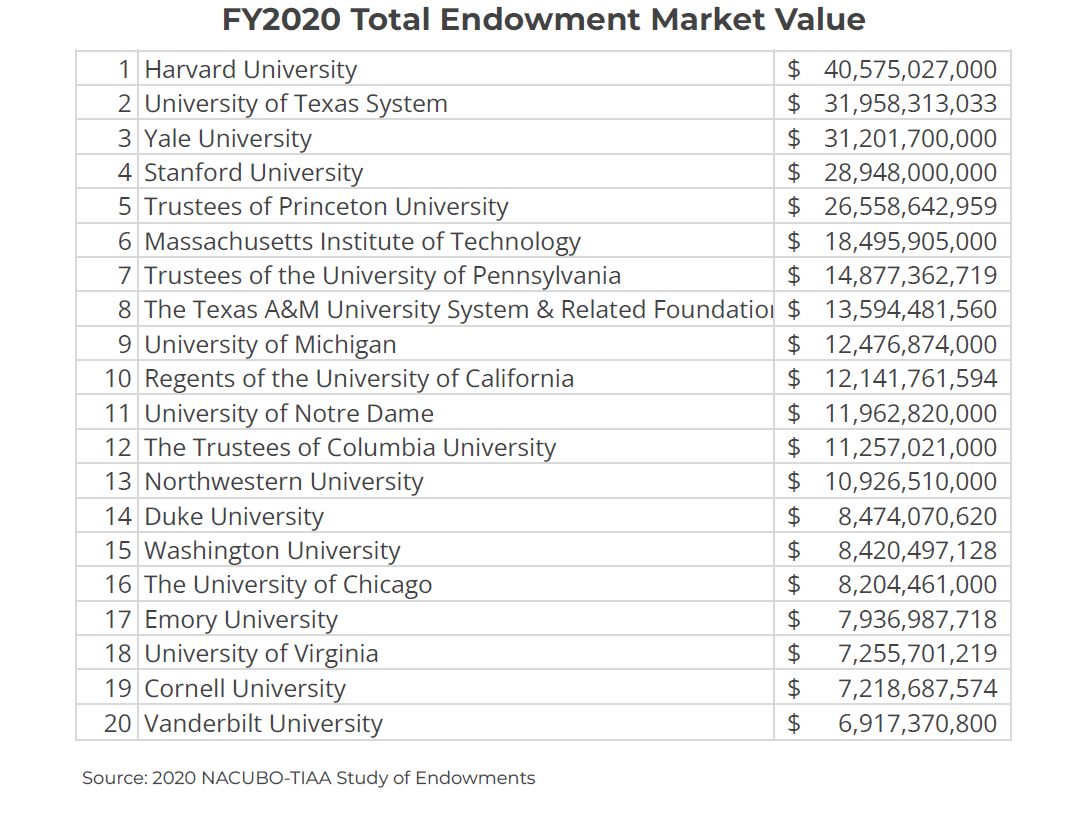

In terms of size, private university endowments are notably dominant. Of the eight-core Ivy League schools, six are counted among the top 20 largest endowments.

How the Yale model created a buzz

Elite university endowments are known for their substantial allocations to alternative assets, including real estate—an approach pioneered by David Swensen.

It would be difficult to overstate the impact of Swensen on the university endowment world. As Yale’s chief investment officer from the mid-1980s until his death in May 2021, Swensen generated an impressive investment track record, driven by an emphasis on alternatives. Many investment professionals admire Swensen’s achievements—and many endowments seek to replicate his results by embracing the “Yale model.”

During his 36 years at the helm:[1]

- Yale produced an annualized gain of 13.7% per annum, outperforming the average endowment by 3.4% per annum, as measured by Cambridge Associates

- Relative to the traditional “60/40 portfolio” comprised of 60% US stocks and 40% domestic bonds, Yale outperformed by 4.0% per annum

- Yale booked nearly $58 billion of investment gains

The Yale Model

In short, Swensen built a portfolio with minimal reliance on traditional stocks and bonds. Instead, he oversaw large commitments to alternatives, such as venture capital, private equity, hedge funds, real estate and natural resources.

When Swensen took over as Yale’s chief investment officer, the fund was invested in a typical 60/40 portfolio. Drawing on the principles of modern portfolio theory, Swensen established a new approach to endowment investing that became known as the Yale model. He expanded Yale’s portfolio into alternatives while emphasizing diversification and seeking opportunities to capitalize on the university’s long-term investment horizon.

Join Chris Loeffler, Caliber CEO, as he shares Caliber’s journey from a small startup to a market leader in commercial real estate asset management and gives key insights on Caliber’s innovative investment approach, including self-directed IRAs and private loans.

There are various approaches utilized by Caliber, such as converting commercial spaces, investing in distressed real estate, and introducing pickleball facilities. In this podcast, Chris discusses the importance and intricacies of approaching opportunity, building investor trust, securing funding, transitioning to the public domain, and maximizing returns within Opportunity Zones.

To download a copy of the slides used in this presentation, click the link below!

https://drive.google.com/file/d/1518oD2pBjn9tAVN5v5MAS7CE5oFNWtE7/view?usp=sharing

Additional Resources:

There are many seasoned investors and advisors who misunderstand critical aspects of Opportunity Zone Investing.

We’ve put together a unique guide to help you educate yourself and avoid some of the common misconceptions:

Click here to get access to “The Accredited Investor’s Guide To Opportunity Zone Investing” today.

If you are ready to speak with a senior member of our Wealth Development team, contact us today to schedule a call.

Important: Investments in Caliber private placements can lose entire value, are illiquid, and are speculative. Refer to the Amended and Restated Private Placement Memorandum (PPM) for a more detailed discussion of risk factors.

How Yale’s Asset Allocation Shifted During Swensen’s Tenure

Endowment asset allocation: An emphasis on alternatives

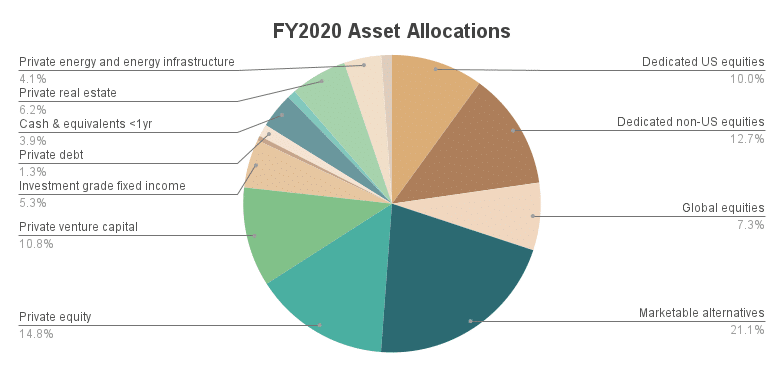

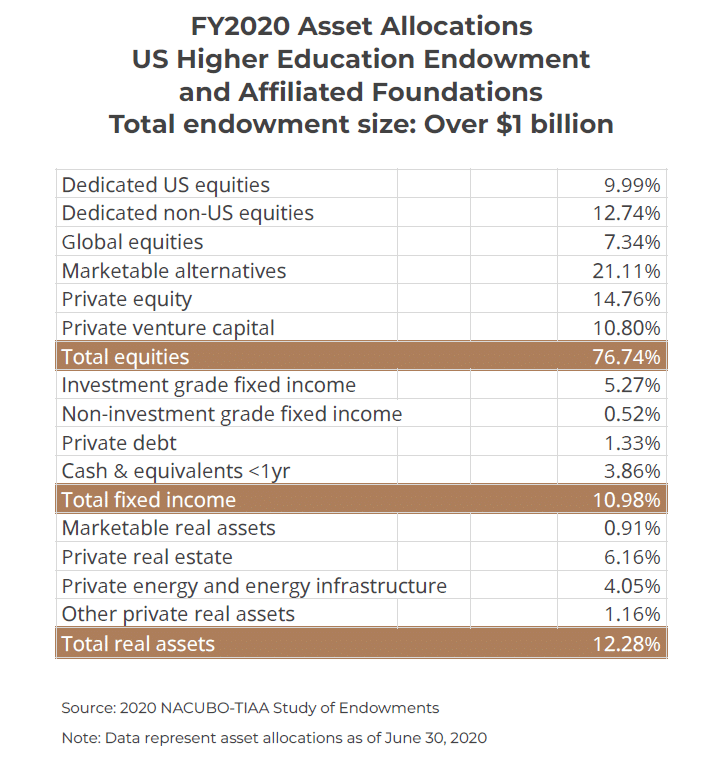

Today, the largest endowments allocate a meaningful part of their portfolios to alternatives in general, and to private investments in particular, including private equity (15%), private venture capital (11%) and private real estate (6%).

Nontraditional asset classes offer compelling return potential and diversifying power—two factors which help explain endowments’ heavy allocation to alternatives. Alternatives tend to be less efficiently priced than traditional marketable securities, providing endowments with a valuable opportunity to capitalize on market inefficiencies. Furthermore, endowments are well suited to exploit the less liquid, less efficient alternatives markets thanks to their long-time horizons.

With the help of alternative asset classes such as real estate, endowments can create portfolios with higher expected returns and modestly higher volatility than the classic 60/40 portfolio.

Absolute returns of elite endowments

How have the alternatives-focused asset allocation strategies performed for elite endowments?

In absolute terms, quite well. Looking at long-term results of the five largest funds, we see impressive performance:

- Harvard – Since its founding in 1974, endowment annualized return has been approximately 11% per year[2]

- UTIMCO – 8.3% annualized return over 20 years ending August 31, 2021[3]

- Yale – Over the ten-year period ending June 30, 2020, the endowment earned an annualized 10.9% return[4

- Stanford – 10.8% net annualized performance for the ten years ending June 30, 2021[5]

- Princeton – 12.7% average annual return on the endowment for the ten years ending June 30, 2021[6]

Relative performance of endowment returns

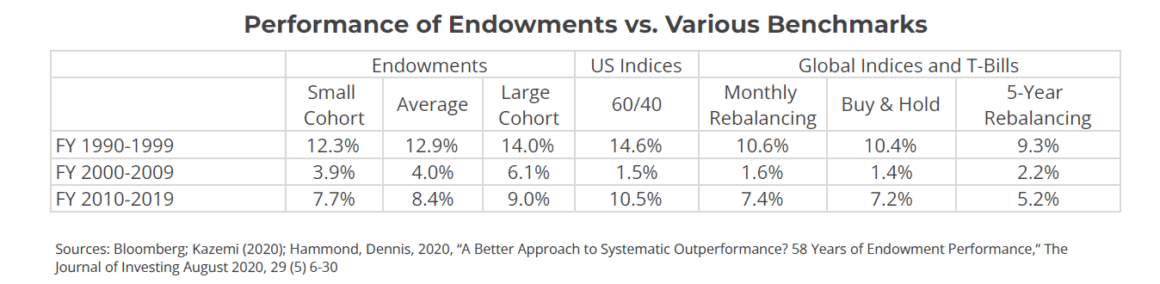

It can be tricky to analyze endowment performance in relative terms. Because we have comparatively sparse data about endowment performance, their estimated risk-adjusted returns change significantly depending on the period selected, the length of the window used and the chosen benchmarks.

The chart below shows endowment performance against a commonly used 60/40 benchmark of US securities as measured by the S&P 500 Index and the Barclays US Aggregate Bond Index.

Other experts, however, argue that the endowments with broad mandates should be measured against globally diversified benchmarks while also recognizing that endowments hold a portion of their portfolios in cash. These benchmark results are displayed in the “Global Indices and T-Bills” columns, which reflect a weighting of 57.6% in the MSCI World Free Index, 38.4% in the Barclays Global Aggregate Total Return Unhedged Index and 4% in short-term US Treasury bills.

Through this lens, assuming five-year rebalancing, endowments have outperformed the benchmark by 2.2% to 3.8% per year since 2010.

For more information, see: Kazemi, Hossein, 2020, “Surprise, Endowments Have Significantly Outperformed the 60/40 Benchmark,” Isenberg School of Management & The CAIA Association

A closer look at endowments and real estate

Asset allocation—specifically, the choice to dedicate meaningful capital to alternative investments—is a key driver of performance for endowments.

Within the realm of alternative investments, real estate plays a particularly important role, delivering diversification benefits while providing steady income and the potential for capital appreciation.

As such, it’s not surprising to see elite endowments target, on average, an allocation of 6% to private real estate.

University endowments >$1 billion Average allocations to private real estate: 6.16% This information is sourced from the 2020 NACUBO-TIAA Study of Endowments.

Yale

- Target real estate allocation: 9.5%

- “Investments in real estate provide material diversification to the Endowment. A steady flow of income with equity upside creates a natural hedge against unanticipated inflation without sacrificing expected return.”[1]

Stanford

- Target real estate allocation: 8%

- “The Merged Pool’s Real Estate asset class is an important diversifying asset class that can help protect the University in inflationary environments.”[2]

Rice University

- Target real estate allocation: 15%[3]

- “To support the in-perpetuity status of the endowment, we believe a long-term portfolio should be equity-oriented, diversified, invested in real assets (real estate/natural resources), value focused and valuation sensitive, fee sensitive, and partnered with managers who have a real investment edge.”[4]

University of California

- Target real estate allocation: 8%[5]

- “The objectives of the real estate portfolio are to contribute to the diversification of the portfolio, generate returns through income and/or capital appreciation, and provide protection against unanticipated inflation.”[6]

What university endowment allocations mean for individual investors

Alternative investments, including real estate, have the capability create meaningful opportunities to grow wealth and bolster portfolio diversification. Elite university endowments are certainly aware of this dynamic.

Ultra-high net worth families with more than $1 billion in assets are also investing substantially in alternatives. Their total alternatives allocations range from 51%-54%, including approximately 11% dedicated to real estate.[7]

Many individual investors, however, fall short of this level, allocating single-digit percentages to alternatives in general, and even less to real estate.

Not every individual can build a portfolio that mimics the elite endowments—nor would it be wise. That said, individual investors can still apply similar principles to their own portfolios, positioning themselves to achieve higher levels of risk-adjusted return. In particular, real estate can play a beneficial role for investors with long-term horizons looking to further diversify their portfolios while capturing income and yield opportunities.

For individuals interested in establishing or growing an allocation to real estate, there are multiple ways to invest, including publicly traded real estate investment trusts (REITs), private equity funds and qualified opportunity zone funds. Each structure provides its own risk and returns profile that investors should consider carefully before investing.

About Caliber

Caliber – the Wealth Development Company – is a middle-market alternative asset manager and fund sponsor with approximately $1.5 billion in assets under management and development. The Company sponsors private funds, private syndications, as well as externally-managed real estate investment trusts (REITs). It conducts substantially all business through CaliberCos, Inc., a vertically integrated asset manager delivering services which include capital formation and management, real estate development, construction management, acquisitions and sales. Caliber delivers a full suite of alternative investments to a $4 trillion market that includes high net worth, accredited and qualified investors, as well as family offices and smaller institutions. This strategy allows the Company to opportunistically compete in an evolving middle-market arena for alternative investments. Additional information can be found at CaliberCo.com and CaliberFunds.co.

Click here to see Caliber’s current property portfolio.

If you would like to speak to someone about diversifying your retirement accounts, contact us at [email protected] or call (480) 295-7600 to schedule a call with a member of our Wealth Development Team.

If you would like to learn more about Opportunity Zone Investing, Caliber has put together a special guide that cuts through the myths and misconceptions and outlines the benefits, the risks, and the upcoming deadlines you must know to be able to participate. Get access to the guide here.

Article Sources

[1] https://news.yale.edu/2021/10/22/david-swensens-coda[2] https://www.hmc.harvard.edu/partners-performance/

[3] 2021 Annual Report, The University of Texas/Texas A&M Investment Management Company

[4] The Yale Endowment 2020, Yale Investments Office

[5] https://news.stanford.edu/2021/10/26/stanford-releases-annual-financial-results-investment-return-endowment-3/

[6]https://www.princeton.edu/news/2021/10/29/princetons-endowment-returns-continue-support-university-mission-and-impact

[7] The Yale Endowment 2020, Yale Investments Office

[8] Stanford University Investment Report 2020, Stanford Management Company

[9] FY20 Endowment Update, Rice Management Company

[10] https://investments.rice.edu/philosophy

[11] Annual Report 2020-2021, UC Investments

[12] https://regents.universityofcalifornia.edu/policies/6102.pdf

[13] https://www.kkr.com/global-perspectives/publications/wisdom-compounding-capital

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.

| 011-CAL-030222 |