To read the full story on GlobeSt., please click here.

An influx of cities are already reaching out for guidance to implement changes across their real estate portfolios as a result of the $1.2 trillion infrastructure bill recently signed by President Biden, JLL reported.

“The bill includes provisions for local governments to hire experts in areas like charging stations, solar energy and renewable energy,” Brian Oakley, Executive Vice President, Public Infrastructure, JLL, said in a post. “Oakley said in a release, “Recognizing the need for charging stations is a great first step. That kind of deployment is a major infrastructure challenge.”

He suggested watching for clean energy and grid-related investments and incentives for public-private partnerships.

Breakdown of the Bill

What remains in this bill’s iteration will have some direct benefits for state and local entities, according to Oakley. The Infrastructure Investment and Jobs Act includes $7.5 billion in grants for governments to consider public-private partnerships for electric vehicle charging stations, among many other investments.

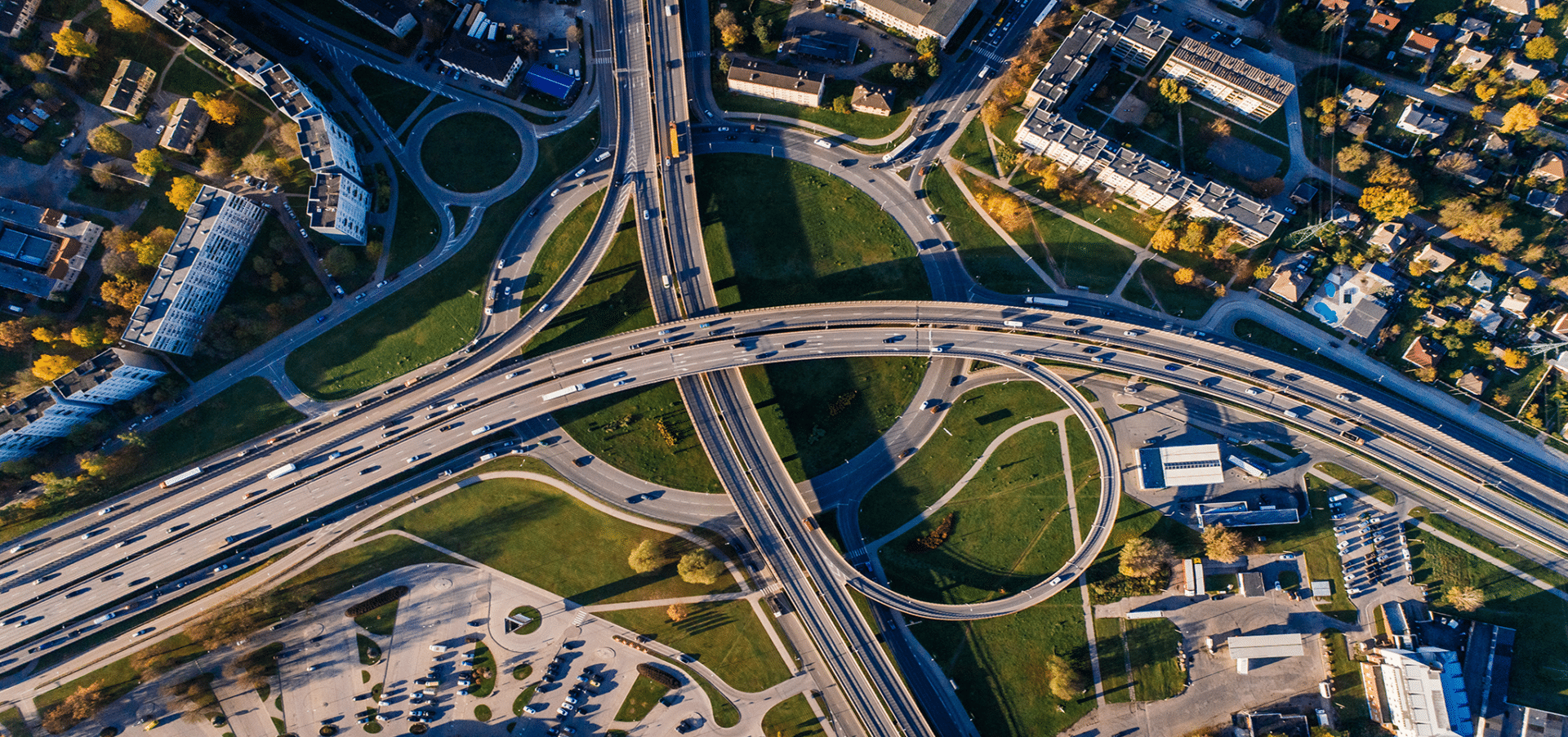

There are significant dollars to be invested in hard infrastructures like roads, bridges, and tunnels.

The $1.2 trillion bipartisan measure also includes:

- $47 billion in climate resilience measures to protect buildings from the storms and fires that result from climate change

- $65 billion to repair and protect the electric grid, build new transmission lines for renewable power and develop nuclear energy and “green hydrogen” and carbon capture technologies

- $39 billion to continue and expand current public transit programs, including help that allows cities and states to buy zero- or low-emission buses

- $66 billion to fix Amtrak and build out its service along the Northwest Corridor, in addition to building tens of millions for high-speed rail and other commuter rail

- $7.5 billion to build electric vehicle charging stations; $25 billion to repair airports to reduce congestion and emissions, encouraging the use of low-carbon flight technology

When asked to comment on the sale, Caliber’s co-founder & CEO, Chris Loeffler responded, “The infrastructure bill will help make sure that more roads, bridges, and other methods of transportation will be improved to ease entry to areas vital to Caliber’s growth and development.”

Caliber operates in several high-growth markets in the West and that “people’s ability to access our projects, whether housing, medical facilities, schools and other amenities is critical to the success of what we build and develop.

To read the full story on GlobeSt., please click here.

Are you interested in learning more about Caliber’s private equity real estate (PERE) funds? Fill out the form below and we’ll contact you as soon as possible to discuss with you our offerings and their potential investment benefits.

About Caliber

As the Wealth Development Company, we are a leading U.S. sponsor with approximately $500 million in assets under development and management. These investments are comprised of alternative investments, which include private funds and syndications, externally managed real estate investment trusts (REITs) as well as public funds. We conduct substantially all business through our Sponsor, CaliberCos Inc., a vertically integrated platform that is strengthened by more than 70 professionals with decades of institutional experience in commercial real estate, capital markets, alternative investments, and mergers and acquisitions.

We allocate our alternative investment strategies and align them with investors’ investment objectives, risk profiles and liquidity preferences to offer an optimal balance of risk-adjusted returns and attractive investment performance. It is because of this thoughtful, intentional approach, and our unwavering pursuit of performance, that we have been deemed The Wealth Development Company.

We strive to build wealth for investors by offering a diverse host of investment solutions that fit our investors’ needs. With a primary focus on key middle-market growth areas, such as Arizona, Colorado, Nevada, Texas, Utah and Alaska, we evaluate other U.S. markets that possess the same attractive demographics and macroeconomic trends as our targeted markets, such as highly skilled labor, emerging population and job growth. In addition, we utilize our institutional full-service operating platform to generate operating efficiencies while enhancing the value of our investments through dedicated asset management strategies.

We create value through a combination of internal and external growth channels. Bringing together the benefits of real estate, deep asset-class, and capital markets expertise across public and private investments. We seed, develop, and manage a broad range of liquid and illiquid alternative strategies for a diverse group of investors who comprise approximately a $4 trillion alternative investment market, which includes high net worth, accredited and qualified investors, as well as family offices and smaller institutions. This strategy allows us to opportunistically compete in an evolving middle-market arena for alternative investments that range between $5 million and $50 million.

Click here to see Caliber’s current property portfolio.

If you would like to speak to someone about diversifying your retirement accounts, contact us at [email protected] or call (480) 295-7600 to schedule a call with a member of our Wealth Development Team.

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.