This is noteworthy as the other states in the top five have the nation’s largest populations… For now.

Click here to read Chris’s full article in Phoenix Business Journal.

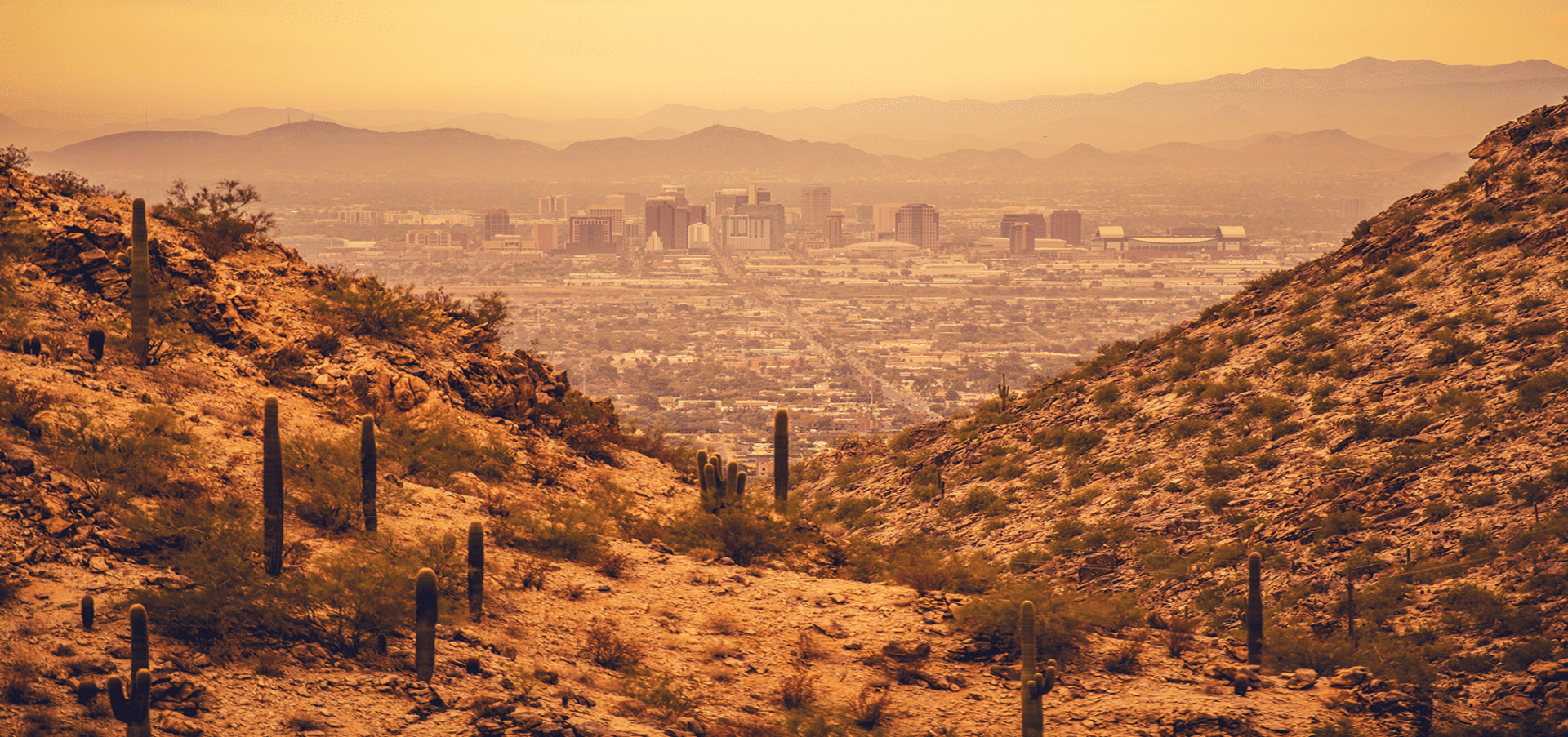

Over the past several years, Arizona has regularly ranked among the nation’s leaders in job creation, wage growth and entrepreneurship. Earlier this year it was announced that Arizona had also become one of the top states for opportunity zone investment — ranking second in the nation. This is noteworthy as the other states in the top five boast the nation’s largest populations (for now). This has resulted in additional investment in Arizona that is rapidly approaching $1.5 billion since the program began just three years ago.

More important than obtaining yet another leading economic ranking for our state, opportunity zone development is delivering vital community assets to areas of our state that are in greatest need of infrastructure, including the lands of several Native American tribes.

Opportunity Zones were created under the Tax Cuts and Jobs Act of 2017 to spur investment in distressed communities. Thousands of low-income communities nationally were given the “O-Zone” designation by state governments. The positive results for the state reflect the careful attention by Gov. Ducey and Arizona Commerce Authority, listening to the input of local communities across the state to design zones that would attract these significant investment dollars.

Taxpayers who invest in Qualified Opportunity Funds (QOF) reap significant tax benefits, but most significantly, the program directs investment dollars into communities traditionally challenged in attracting major project funding.

In our case, Caliber Wealth Development has utilized this federal incentive to drive urban redevelopment, build psychiatric hospitals, schools on indigenous community land, and construct hotels and attainable housing in areas in need of development. Developing and expanding schools that foster educational opportunities is a key mission of Caliber’s Opportunity Zone Fund. A groundbreaking for one of these school construction projects recently took place on the lands of the Salt River Pima Maricopa Indian Community…

Click here to read Chris’s full article in Phoenix Business Journal.

Join Chris Loeffler, Caliber CEO, as he shares Caliber’s journey from a small startup to a market leader in commercial real estate asset management and gives key insights on Caliber’s innovative investment approach, including self-directed IRAs and private loans.

There are various approaches utilized by Caliber, such as converting commercial spaces, investing in distressed real estate, and introducing pickleball facilities. In this podcast, Chris discusses the importance and intricacies of approaching opportunity, building investor trust, securing funding, transitioning to the public domain, and maximizing returns within Opportunity Zones.

About Caliber

About Caliber

Caliber – the Wealth Development Company – is a middle-market alternative asset manager and fund sponsor with approximately $1.5 billion in assets under management and development. The Company sponsors private funds, private syndications, as well as externally managed real estate investment trusts (REITs). It conducts substantially all business through CaliberCos, Inc., a vertically integrated asset manager delivering services which include capital formation and management, real estate development, construction management, acquisitions and sales. Caliber delivers a full suite of alternative investments to a $4 trillion market that includes high net worth, accredited and qualified investors, as well as family offices and smaller institutions. This strategy allows the Company to opportunistically compete in an evolving middle-market arena for alternative investments. Additional information can be found at CaliberCo.com and CaliberFunds.co.

Click here to see Caliber’s current property portfolio.

If you would like to speak to someone about diversifying your retirement accounts, contact us at [email protected] or call (480) 295-7600 to schedule a call with a member of our Wealth Development Team.

If you would like to learn more about Opportunity Zone Investing, Caliber has put together a special guide that cuts through the myths and misconceptions and outlines the benefits, the risks, and the upcoming deadlines you must know to be able to participate. Get access to the guide here.

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.

035-CAL-042722 |