The current landscape in hospitality real estate presents a rare, time-sensitive investment opportunity. Here we explore the unique market conditions and economic factors that make this an opportune moment for investors.

Why buy hotels today? Exceptionally favorable market conditions

Let’s start with supply, demand, and the real estate cycle. Between 2016 and May 2022—when interest rates started climbing—we were in a development phase of the real estate cycle. In a development phase, it makes sense for investors to buy land and build assets. Asset prices are increasing, and demand exceeds supply, offering a nice profit spread for developers. Eventually, supply exceeds demand, and the real estate cycle moves to a different phase.

Typically, the first assets to be built in a development phase are the most straightforward, such as multifamily buildings and single-family homes. The last assets to be built are the more difficult types, like specialized medical facilities and hospitality, given that hotels aren’t just real estate assets but also operating businesses.

In 2018-2019, we saw more developers beginning the multiyear process to build hotels; however, many of these projects were slowed, stopped, or canceled altogether when the COVID pandemic hit in 2020. As a result, an oversupply of hotels never materialized as it typically would in a normal real estate cycle. Plus, during the pandemic, many hotels were converted to alternate uses—such as apartments or assisted living centers—further constraining hotel supply.

As demand continues to rise in the post-pandemic environment and supply remains limited, we believe investors are presented with a great opportunity to own hotels.

Hotel owner-operators willing to look at alternative transactions

Our bullish outlook on hotels is supported by a second compounding factor: Many hotel owner-operators continue to experience pandemic-related financial distress and need access to outside sources of capital. Pain points for owner-operators include struggles to refinance debt, requirements from hotel brands to complete costly renovations, and desire to get out of personal loan guarantees.

Taken together, these considerations increase owners’ willingness to look at alternative transactions—especially transactions that can provide capital while also protecting their portfolio and allowing them to retain an ownership stake

Timely opportunity for a middle-market REIT

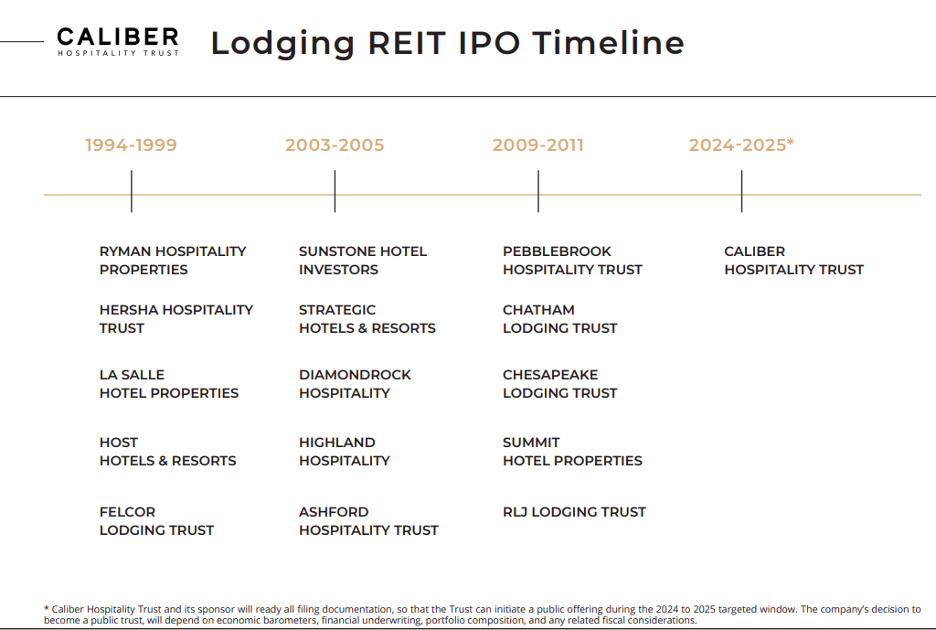

For the most part, hotel assets are held by a small group of players, making it hard to break into hospitality investing. After a big disruption, however, hotel owner-operators may be spurred to seek outside capital, as we described above. Historically, this dynamic has created opportunities to build large-scale hospitality investment companies, as illustrated below.

We believe the current moment presents one such window of opportunity. Specifically, we see white space in the marketplace for a middle-market REIT that aggregates and elevates full-service, select-service, lifestyle, and extended-stay hotels.

CHT: Purpose-built to capitalize on current conditions

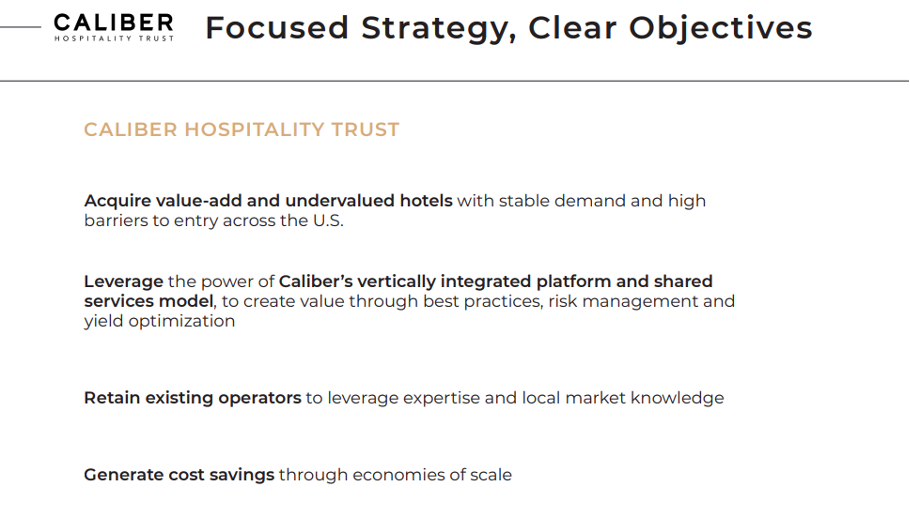

Caliber Hospitality Trust (CHT) is an innovative, diversified, externally advised private hospitality company formed by CaliberCos Inc. to capitalize on the unique opportunity created by the pandemic to acquire hotels at discounted valuations. CHT is targeting middle-market full-service, select-service, extended-stay, and lifestyle hotels in attractive geographic locations. We designed the business model to make the most of current industry economic conditions with a win-win solution for investors and hotel owners.

If this opportunity resonates with your investment objectives, contact our team to learn about the next steps.

Let’s Connect

Would you like to discuss this article with one of our Wealth Development Representatives? Fill out the form below to be connected.

About Caliber (CaliberCos Inc.) (NASDAQ: CWD)

With more than $2.9 billion of managed assets, Caliber’s 15-year track record of managing and developing real estate is built on a singular goal: make money in all market conditions. Our growth is fueled by our performance and our competitive advantage: we invest in projects, strategies, and geographies that global real estate institutions do not. Integral to our competitive advantage is our in-house shared services group, which offers Caliber greater control over our real estate and visibility to future investment opportunities. There are multiple ways to participate in Caliber’s success: you can invest in Nasdaq-listed CaliberCos Inc. and/or you can invest directly in our Private Funds.

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.

Stay up to date on Caliber fund updates and more.