Many headwinds exist for the markets and a Trump economy. The big question, for most of us, is how to invest in times of uncertainty, at the end of a long bull market with a historically high priced stock market. People ask me what investment area looks most attractive to me currently? My answer is, alternative investments; however, not all alternative investments are similar.

When President Trump won the election, the stock market took a sudden turn up on the optimism that his policies were not necessarily negative like many in the media had portrayed. On election evening, when it became apparent that he would win, the futures markets were down sharply with the new uncertainty. As Trump’s policies were restated in the media, people realized one by one that his policies were not bad for the economy, but actually could and should be good. As the election results unfolded overnight, the futures markets took a turn north and regained almost all the losses throughout the night. When the markets opened up the next morning, they were not down 5%, but close to even to the surprise of many.

Confidence soared in the stock market as the S&P 500 went 110 days without a 1% sell off. The last time that happened was in 1995. That run-up has taken many stocks up to a level that is priced to perfection and does not leave much margin for error in either the economy or their own business execution. According to the World Bank, the total U.S. stock market is now valued at more than 150% of annual GDP, gross domestic product, a level not seen since 2000. Consumer confidence is at a level rarely seen and is as high as it was in the 1997-2000 technology boom, according to the Conference Board Index of Consumer Confidence.

Time will tell if President Trump can implement his policies in the way he would like and in the timeframes he is hoping. We got a quick look at what the markets think when his agenda does not get supported as the markets dropped when the first attempt to repeal and replace the Affordable Care Act did not pass in Congress. Therefore, if the approval and implementation of the President’s tax restructuring and growth policies don’t get approval, it may disappoint the markets. Many other headwinds still exist for the markets and economy such as rising interest rates. Historically rising interest rates and shrinking Federal Reserve Bank balance sheet have not been good for the economy. Essentially both measures take money out of circulation within the economy which slows and reduces overall business transactions. The threat of nuclear war in or with North Korea, followed by deteriorating US-Russia and Mideast relations can certainly weigh on the global economy as less people may travel and corporate investments can slow due to uncertainty.

The big question, for most of us, is how to invest in times of uncertainty, at the end of a long bull market with a historically high priced stock market. Buying stocks at a time like this is difficult and can result in large losses and long periods of time to recover. For example the S&P500 took 7 years to recover from its peak in March of 2000 and 5 ½ years to recover from its peak in October of 2007. That’s a lot of waiting around to recover from losses and get back to break-even. Many don’t have that kind of time left to invest for their retirement.

Investing in fixed income currently is a challenge as the interest rate returns are extremely low in the current low interest rate environment. This also creates a challenge for bonds as the face-value goes down as interest rates rise.

Again what investment area looks most attractive to me? Alternative investments; however, not all alternative investments are similar. I favor the shorter-term alternative investments like index options strategies that go month to month and are tax favored or Real Estate loans or investments that generate cash flow. Alternative investments like oil exploration or gold mining projects can be very long-term cash intensive investments that can take years to pay off if ever.

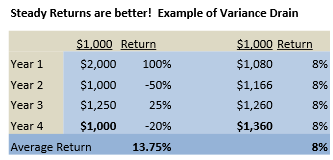

One is also rewarded for steady rates of return, which are important, because volatility often hurts the overall returns in the long run and if you need to pull your money out and you are on a downswing, it comes with a reduced expectation of funds. Refer to this example of volatile returns verses steady returns below, both over a 4-year period.

The first example is up 100%, than down -50%, then up 25%, then down -20%. The annual average rate of return arithmetically is 13.75% per year, yet you still only have $1,000 at the end of 4 years. The 2nd example is a steady 8% return per year. To the surprise of many, you’ll have more money at the end of the steady 8% annual return than the volatile 13.75% average return. Note the value of each after 4 years, $1,000 vs. $1,360. Therefore, we are supportive of steady returns first and foremost, and recommend seeking them from alternative investments. The results can be rewarding, provide great diversification, and offer protection from volatile markets.

Post by Chuck Brokop

President of Clear Stream Advisors, Inc

Contact us today to learn more about Caliber’s investment opportunities and open funds.