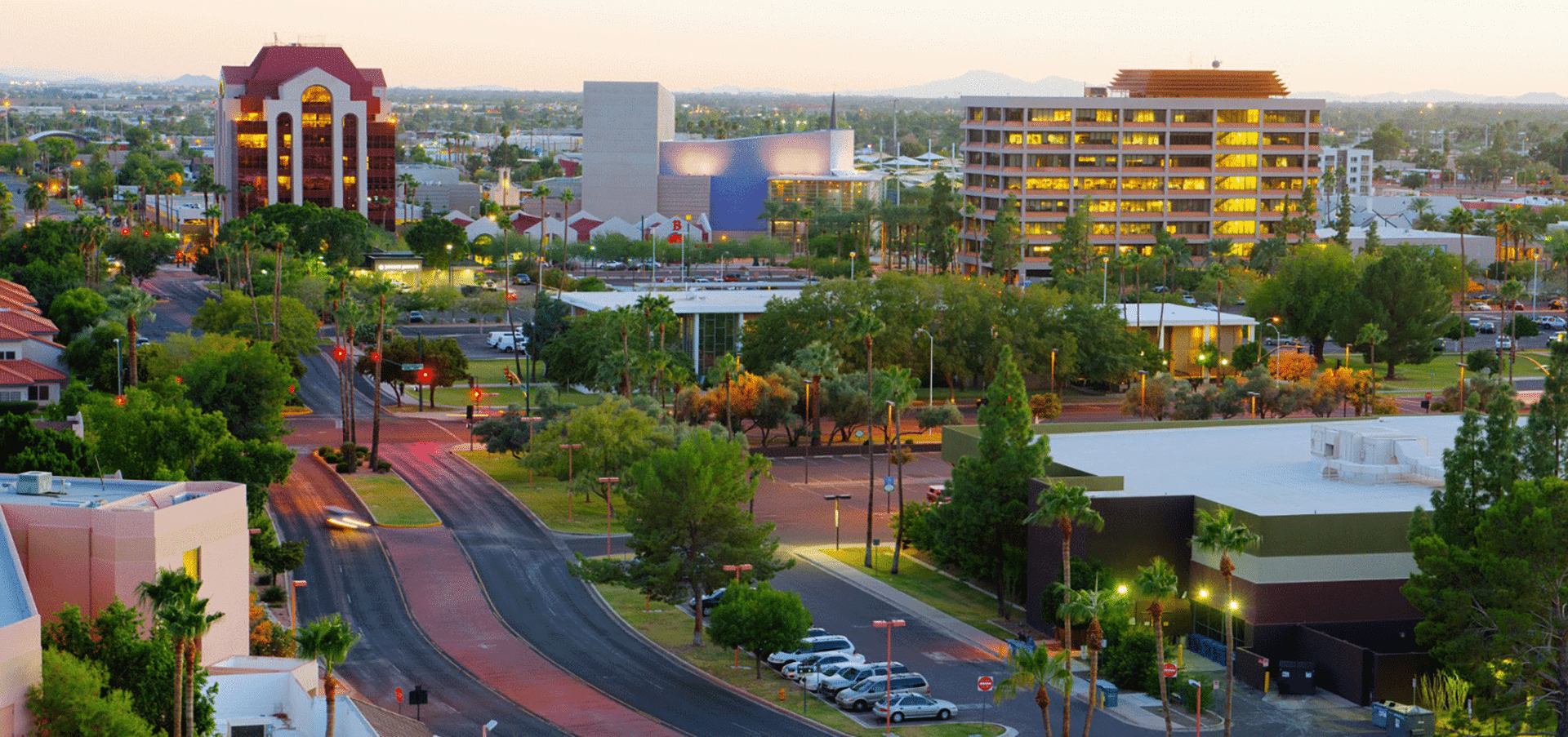

Caliber spends over $5 million on revitalizing properties on Main Street of Arizona’s 3rd Largest City.

Many people who visit downtown Mesa agree that the historic center of the third largest city in Arizona could be more than it currently is.

It has good bones, the prevailing theory goes; it just needs a few missing pieces to bring it fully to life.

Beginning this month, a wave of revitalization projects is coming online, testing the city’s current strategy for igniting downtown development…

Scottsdale-based investment firm Caliber, which bought up eight downtown properties in 2018, says it will be opening a coworking space “in the next few months,” according to Caliber President and COO Jennifer Schrader. Additionally, Caliber announced signing lease deals with two entertainment businesses beginning in early 2023: Level 1 Arcade Bar, which will be moving into 48 W. Main Street, and Copper City Spirits, which will occupy 155 W. Main Street.

“You should potentially see a new business [open on mainstreet] every three to six months [by 2023].”

Jennifer Schrader – President & COO

Caliber’s effort to revitalize the 3rd largest city in Arizona is backed and appreciated by Mesa Mayor John Giles:

“We appreciate Caliber’s investment and commitment to our downtown and we’re excited for more people to have the opportunity to live here,” Mayor John Giles said in a statement. The Commons of Mesa will be a great addition.”

Join Chris Loeffler, Caliber CEO, as he shares Caliber’s journey from a small startup to a market leader in commercial real estate asset management and gives key insights on Caliber’s innovative investment approach, including self-directed IRAs and private loans.

There are various approaches utilized by Caliber, such as converting commercial spaces, investing in distressed real estate, and introducing pickleball facilities. In this podcast, Chris discusses the importance and intricacies of approaching opportunity, building investor trust, securing funding, transitioning to the public domain, and maximizing returns within Opportunity Zones.

About Caliber

Caliber – the Wealth Development Company – is a middle-market alternative asset manager and fund sponsor with approximately $2 billion in assets under management and development. The Company sponsors private funds and private syndications. It conducts substantially all business through CaliberCos Inc., a vertically integrated asset manager delivering services which include capital formation and management, real estate development, construction management, acquisitions and sales. Caliber delivers a full suite of alternative investments to a $4 trillion market that includes high net worth, accredited and qualified investors, as well as family offices and smaller institutions. This strategy allows the Company to opportunistically compete in an evolving middle-market arena for alternative investments. Additional information can be found at CaliberCo.com and CaliberFunds.co.

CONTACTS:

Caliber:

Victoria Rotondo

+1 480-295-7600

[email protected]

Media Relations:

Kelly McAndrew

Financial Profiles

+1 203-613-1552

[email protected]

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.

| 126-CAL-0080122 |