Wealth Advisors and Individual Investors seeking monthly income, growth of capital and overall portfolio stability, traditionally choose real estate. It is a proven strategy to build and secure wealth. The problem is always access to good deals, structure, and time. Investing in single family rental properties is a great option – until investors find themselves faced with the ever-increasing burden of management. Commercial properties are also a great alternative – unfortunately, even the wealthiest investors struggle to purchase these assets on their own. This leads to a question I hear all the time – “I want to take advantage of the proven benefits of real estate in my portfolio, but I can’t do it alone. What are my options?”

Many who ask this question are familiar with my first of two answers: Publicly-Traded Real Estate Investment Trusts (REITs). However, the second, lesser known option for investors, Private Placements, often captures the attention of those who are eligible to invest due to the distinct advantages. This conversation now presents a new question “Which option is best for my portfolio?”.

Neither option is right or wrong – in fact, strong portfolios will often feature both. The important part is understanding the structural and management differences between the two vehicles to ensure you’re equipped with the knowledge necessary to make an empowered investment catered to your goals. Let’s explore some of the biggest differences between REITs and Private Placements.

REITs Offer Higher Liquidity

A common theme for advisors and individual investors to pursue REITs is instant liquidity, similar to a stock or mutual fund investment. This high level of liquidity is one reason that REITs are open to all investors, while private placements, which rarely offer comparable levels of liquidity, are only available to accredited investors. On the other hand, Non-Traded REITs, which aren’t traded on a securities exchange, are similar to private placements with illiquidity and often can have lock up periods as high as 7 years.

Private REITs May Be Liquid – But it Will Cost You.

Investing in Real Estate is costly, therefore both Private Placement and REIT investments alike will be accompanied by fees. The high upfront fees and commissions of a REIT results in less capital that can be put to work in actual real estate investments. Alternatively, Private Placements are structured to keep interests aligned between the investor and manger. This means capital is used productively and efficiently from the start, and profit is taken on the backend. On average, REITs will get $0.85 of every dollar invested while Private Placements will get $0.95+ of capital into the asset. With Private Placements generally taking a profit split on the back end, after a preferred rate of return, the manager is incentivized to perform rather than just sell.

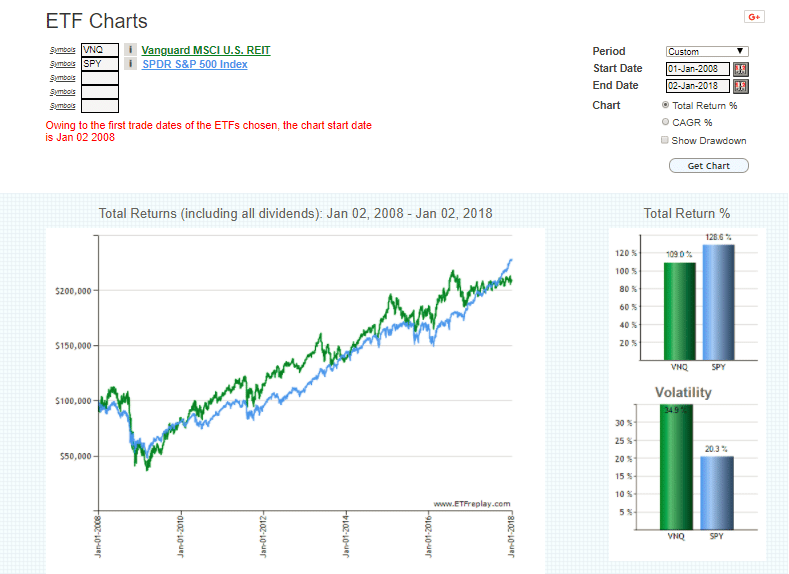

The chart above shows the Vanguard REIT index and S&P 500 over the last decade. As one can see, the two indices move almost in lock step. The only problem is that generally most individuals want to invest into property to diversify away from the stock market. The point is not that the real estate owned by REITs is somehow correlated to the overall market, but rather there is a disconnect between the trading REIT and the underlying assets. Therefore, individuals who are seeking true asset diversification are better off exploring private placements over REITs.

Furthermore, a look back at the financial crisis shows this disconnect as well. NCREIF is an index that tracks private real estate and NAREIT is an index that tracks the REIT market. Between the months of September 2008 and February 2009 NAREIT fell about 60%, while NCREIF only fell 15%. Again, clearly the real estate within these REITs did not lose 60% of their value, however the investors in these REITs still had to recognize these losses due to the fact that REITs trade on an exchange.

Taxes & Distributions

Private Placements offer distinct tax advantages to investors – a large advantage over REITs. Much like dividends from stocks and ETFs in a brokerage account, the income that comes from REITs is all taxed as ordinary income via 1099. In any equity position through Private Placements, investors are issued a scheduled K-1. K-1s can pass along depreciation to the investor and negate some of the income that is passed through, while REITs are required to pass along 90% of their income to the investor which is tax-advantaged for the REIT but unfortunately not for the investor.

As it relates to the distributions on these two investments, REITs have mandatory distributions while private placements leave the decision up to the fund manager. With the Private Placement model, the manager can wait until the asset has the appropriate amount of cash on hand before making an income distribution. At Caliber, this is one of our core investment principles – we believe in doing what is right for the asset, at the right time. With the REIT model, the mandatory quarterly distributions often appeal to an investor, however, they can be harmful to the underlying asset. Furthermore, the distributions from a Private Placement must be from derived cash flow, while REITs can make the distribution with new investor capital.

Acquiring Assets, the Right Way.

While the aforementioned differences between these two opportunities are pretty straight forward, the due diligence process for acquiring properties is an often overlooked, but extremely important, variance. Since there are not open shares to the public with Private Placements, the management is not forced to rush the process of immediately deploying investor capital. This allows the fund managers to do the proper due diligence on every asset that comes through the pipeline, ensuring it is a good investment for both the individual investor and the manager. With capital coming into REITs daily, the manager is hurried to buy assets, often without taking the proper steps in the acquisition process. Many REITs end up simply acquiring more property for the sake of more property, disregarding the actual value each asset adds.

Finding Peace of Mind Through Direct Access to Management

With any investment, investors always want to feel a sense of security. For many, being able to talk directly to the individuals making decisions regarding their capital provides peace of mind for investors. Like a Mutual Fund, a REIT has a manager, or team of managers, that make the decisions regarding all aspects of the investment cycle. Most individual investors, and even Wealth Managers offering these REITs to their clients, have little to no interaction with the fund managers, ultimately leaving them in the dark about where and how their capital is being utilized. With the consumer branded approach at Caliber, when you invest with us our team becomes your team. This means our investor base can leverage the knowledge and experience of our industry professionals, and not only maintain constant contact with their wealth development representative, but also have direct access to the Executive Team and Fund Managers. This allows our clients to have a sound understanding of the strategy involved in their respective investments, resulting in an empowered investment decision every time.

The bottom line is there is no right or wrong answer – investments are never one size fits all. Accordingly, investment vehicles, with their varying benefits and strategies, should be reviewed carefully. Regardless of an investors decision to move forward with a REIT or private equity firm, it is vital for the client to understand the liquidity, fees, distributions, management and overall structure of each option to ensure they choose a portfolio addition that will work cohesively with their investment goals.