Ground leases are high-risk and high-reward opportunistic investment options for investors looking to add long-term growth returns and potentially reoccurring distributions to their portfolios.

Over the years, investing in ground leases has become an increasingly attractive option for investors focused on adding commercial real estate assets or funds as a diversifying component in their portfolios. By investing through a fund sponsor, accredited investors commit their funds to help the fund sponsor acquire, develop, manage and/or sell the asset. But, as with any investment strategy, there are both pros and cons that need considering before any capital is committed to any investment.

Before we get into the pros and cons, let’s discuss what a ground lease is and how it works.

What is a ground lease?

Prime pieces of property are often rare and very expensive. Ground leases make it easier for tenants to develop land they might not have access to otherwise.

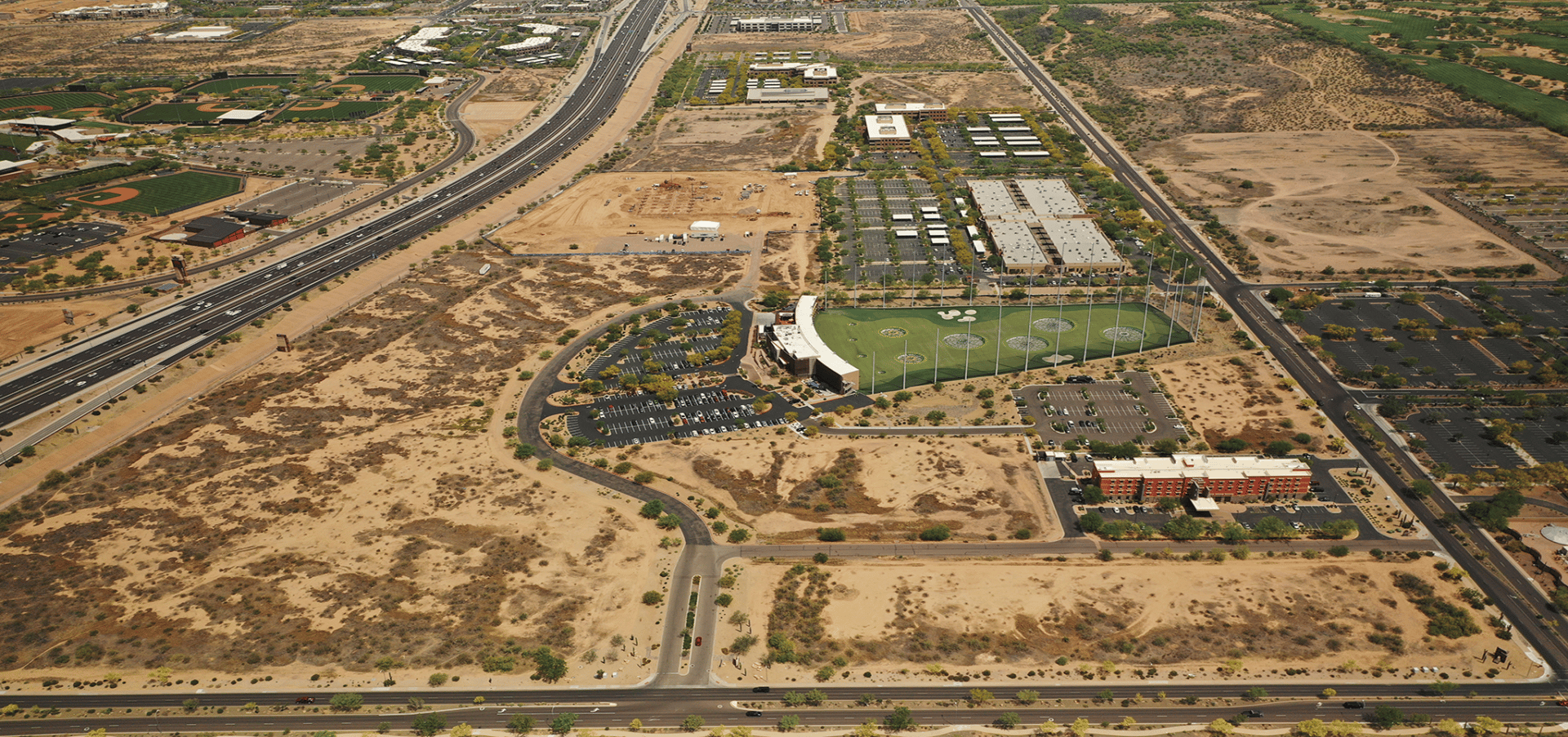

Unlike triple net investments, which consist of both land and buildings, ground leases consist of land only. Landlords can lease undeveloped commercial land to tenants, who are granted full rights to construct and operate on the property.

Here’s how this works. During the beginning stages of a ground lease, the landowner and future tenant create an agreement allowing the tenant to begin leasing land for their new build. Typically, these leases are long-term, lasting anywhere between 50 to 99 years and once the lease expires, the landowner is generally given ownership of the building. The same goes if the tenant ever fails to pay rent.

The Pros and Cons of Investing in a ground lease

Before committing any capital to a ground lease investment, you should ensure the pros and cons it and what your risk tolerance is.

The Pros of Investing in a Ground Lease

- Expanded access to financing options due to potentially better credit ratings associated with reliable fund sponsors and landlords managing these properties. A fund manager targeting mid-market CRE deals can benefit from this arrangement, as its credit ratings rise due to a history of successful investments. This can translate into better loan terms for the fund sponsor when seeking out additional financing for their other investments.

- Opportunity to generate long-term returns if the strategy employed and the assets developed on the land are in better shape than the surrounding businesses who came before it. For example, a fund manager may potentially find itself in a position of having limited access to certain property types during times of price volatility or economic downturns. However, acquiring ground leases may be a valuable asset to acquire even during times of uncertain volatility and inflation, giving accredited investors an opportunity to access valuable deals at discounted rates.

- Tax benefits are potentially available as the asset manager recaptures capital depreciation from investing tenants. For example, the asset manager can reap significant tax savings if the tenants invest any capital into the property they’re leasing from the manager. This may include allocating funds to updating appliances and furniture or making repairs and renovations; any increase in the asset’s value, made due to such modifications to it, will be captured upon the sale of the asset and it can result in greater financial gains for the investor.

- Increased tenant control of improvements and expenditures that are customizable to the lessees renting the business space. For example, a private equity real estate (PERE) asset manager specializing in middle-market investments may choose to invest in a ground lease that is large enough to build various assets including multi-family, hospitality, healthcare, multi-use, business, retail or other diverse property types. Since any development on this land parcel is built from the ground up, the tenant gets a built-to-suit space that fits their needs, within budget.

The Cons of Investing in a Ground Lease

- Complex leasing regulations vary between different states and local jurisdictions and require legal help before any capital is committed to investing in a ground lease. For example, investors must be aware of the differing leasing laws between states and municipalities. This makes it very important that they seek out experienced counsel before committing to any agreement involving ground leases.

- Possible monetary costs for upfront legal fees and for ongoing workshare expenses related to managing property aspects (e.g., taxes and insurance premiums). For example, fund sponsors must factor the cost of engaging qualified attorneys, along with every potential human and resource cost associated with the project into the payment plan prior to purchasing the asset.

- Tenant security cannot be guaranteed as there’s no certainty regarding the occupants’ future financial obligations or stability over time in high turnover industries such as hospitality or retail: for instance, if an asset manager invests in a ground lease to build properties for differing types of tenants such as MFR, retail, entertainment, etc., The sponsor cannot provide any assurances of whether those tenants will continue paying their rent beyond the initial lease term because occupancy rates are subjected to ever-changing external factors that may disrupt economic markets.

Conclusion

If you’re looking to invest in commercial real estate assets or funds to enhance your estate planning goals, researching land lease opportunities can potentially, positively affect your portfolio in numerous ways including:

- Diversification – Adding real estate investments can help offset the damage done by tumultuous markets, inflation and other macroeconomic variables. Additionally, after vertically developing the land lease, there may be an array of asset classes like multi-family, hospitality, mixed-use, retail, business, healthcare and more that can diversify your portfolio further, as these property types also vary in performance during bull, bear, volatile and inflated markets.

- Long-term growth of investment – Investing in leased land is a long-term play, but this high-risk/high-reward strategy can potentially offer investors sizable capital gains compared to other alternative or traditional investment offerings.

- Generate predictable income – The properties that make up the land lease asset may disburse passive income to investors once the buildings are constructed, leased out and making a profit.

Accepting Investments Now:

Watch: Caliber Opportunistic Growth Fund III

Watch: Caliber Qualified Opportunity Zone Fund II

Click here to review our assets.

About Caliber

Caliber is a leading vertically integrated asset management firm whose primary goal is to enhance the wealth of investors seeking to make investments in middle-market assets. We strive to build wealth for our investor clients by creating, managing and servicing proprietary products, including middle-market investment funds, private syndications, and direct investments. Our funds include investment vehicles focused primarily on real estate, private equity, and debt facilities. We market our services through direct sales to private investors, wholesaling to investment advisers, direct sales to family offices and institutions, and in-house client services. Caliber’s middle-market specialty allows the Company to compete with agility and speed in an evolving arena of alternative investments. Additional information can be found at Caliberco.com and CaliberFunds.co.

Click here to see Caliber’s current property portfolio.

If you would like to speak to someone about diversifying your retirement accounts, contact us at [email protected] or call (480) 295-7600 to schedule a call with a member of our Wealth Development Team.

If you would like to learn more about Opportunity Zone Investing, Caliber has put together a special guide that cuts through the myths and misconceptions and outlines the benefits, the risks, and the upcoming deadlines you must know to be able to participate. Get access to the guide here.

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.

334-CAL-032023