Dividend stocks are not the only way to build wealth—private equity real estate can be a highly lucrative option for growth and income investors.

For the past several decades, dividend investing has been a cornerstone of traditional asset allocation. Investors and analysts considered stocks that pay dividends to be superior and, therefore, a worthwhile addition to a growth and income portfolio. Pair a handful of quality, dividend-paying stocks with some government bonds, and you have a portfolio mix that was difficult to beat (historically).

But two notable changes have undercut the otherwise staid value proposition of dividend investing: aggressive central bank policy and the rise of internet-based growth companies. Barely-there bond yields and a broad reduction in dividend yield meant that the two formerly reliable parts of the portfolio are now under threat. This change in outlook for more conservative investors is particularly true for those using stock index funds for their equity exposure. Tech stocks tend not to pay a dividend and now occupy a larger percentage of the index. As of February 2020, just five companies make up 18% of the S&P 500.

In our view, private real estate offers a stronger alternative to stocks and bonds for an investor seeking a combination of growth and income. Since 1995, global private real estate has outperformed both dividend stocks and the general market on a total return basis, remaining uncorrelated to general market conditions, and also offers a hedge on inflation. While past performance is no indication of future results, our confidence has never been higher in private real estate’s potential to produce for investors.

does private equity real estate outperform stocks?

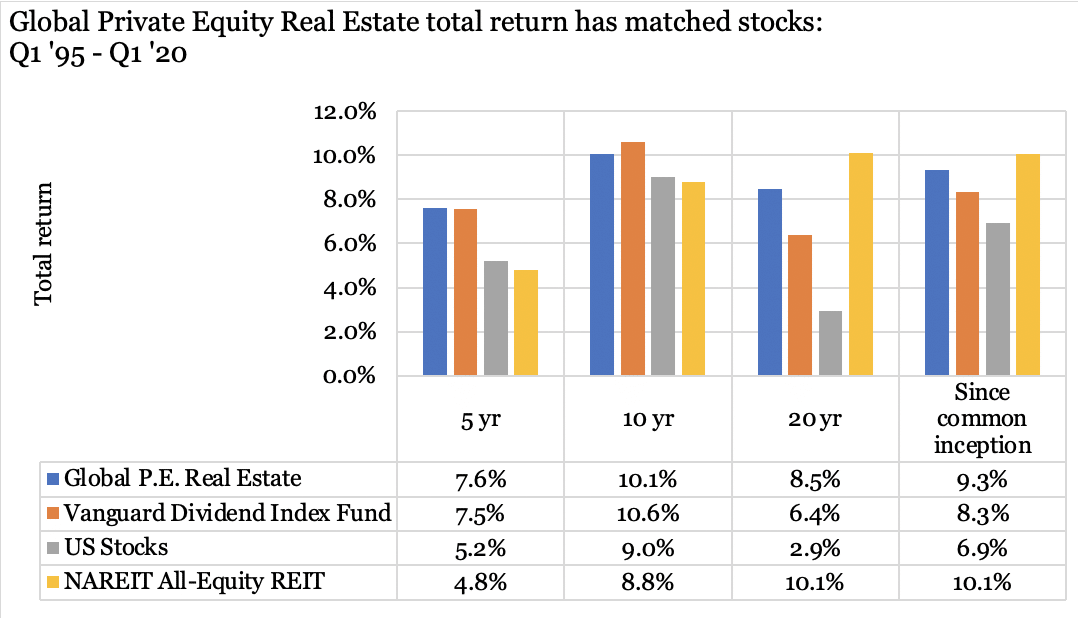

Unlike publicly-traded companies, tracking down reliable data for private investments is notoriously tricky. Based on data obtained from Cambridge Associates, Global Private Equity Real Estate (Global PERE) has outperformed both the general US stock market and a leading dividend-focused index fund since common inception of Q1 1995 through Q1 2020 and matched or exceeded both over the last five, 10 and 20 years.

These figures are good, but does Global PERE really separate itself from the pack? Dividend stocks beat Global PERE on a 10-year basis (by 50 basis points) and are competitive since common inception. Meanwhile, REIT stocks outperform on a long-term basis. Case closed? Well, what if we adjust these returns by volatility?

Volatility is another way of saying standard deviation, a statistical measure to what degree values deviate from the mean (or average) value. A lower standard deviation figure implies lower volatility, whereas a higher standard deviation figure implies higher volatility. Modern Portfolio Theory uses volatility as a proxy for risk. Significant deviations from the mean increase the probability of buying or selling at the wrong time, potentially decreasing returns. For example, sell-offs in the market are an excellent time to buy, particularly in an overvalued market (like now ). Yet, if volume is any indication, most market participants tend to sell out to cash or rotate to something perceived to be more defensive. A market decline is an opportunity to buy highly appreciated assets, essentially, on sale.

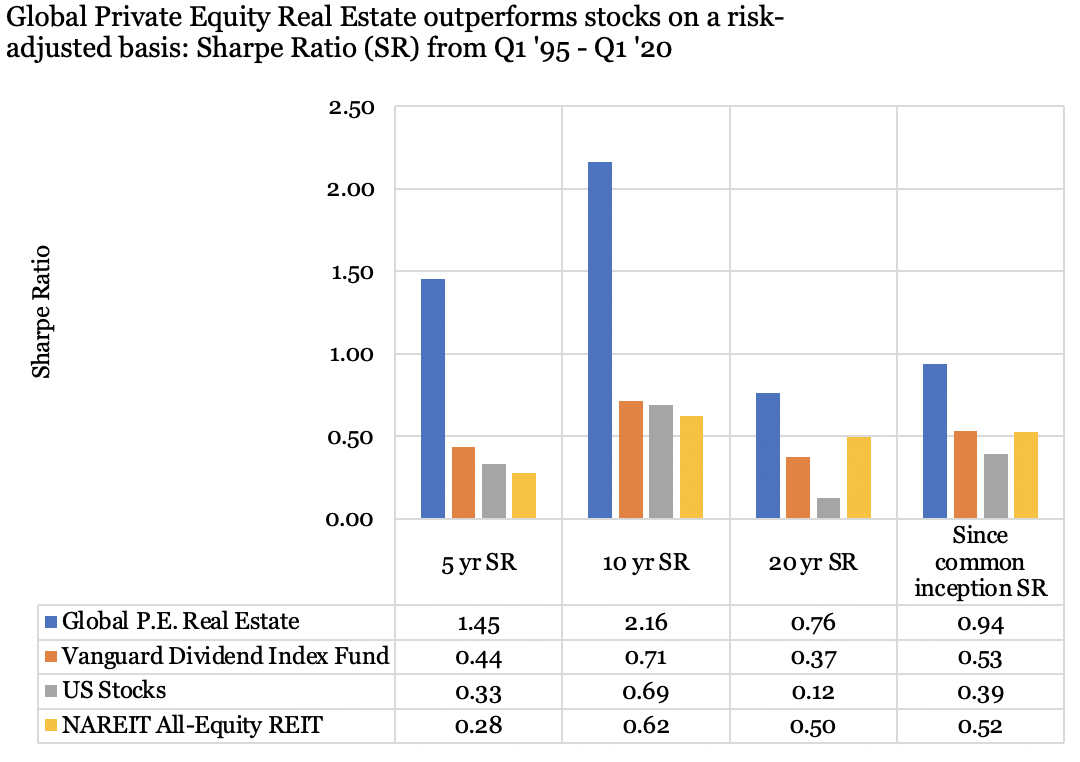

The Sharpe Ratio (which uses total return less the risk-free rate—we use 1%—as the numerator, divided by annualized volatility as the denominator) tells us how much return we receive, adjusted for volatility. A Sharpe Ratio of 1.00 tells us that we receive a 1% return for every 1% of risk; a Sharpe of 0.50 means we receive 0.5% return for 1% of risk; a Sharpe of 2.0 means we receive 2% return for every 1% of risk.

Given that, what does the above chart’s returns look like if we adjust the returns for volatility? In other words, let’s adjust for our experience rather than just the total return:

Let’s assume that investors are biased toward investments that offer the highest return with the lowest risk. In that case, Global PERE becomes a clear winner: the asset class dramatically outperforms stocks over a five-, 10-, 20-year basis, and since common inception.

Generally, private investments tend to have lower volatility than public investments. That’s largely due to the difference between public and private investments. Public investments’ value gets appraised intraday, whereas private investments’ appraisal occurs quarterly at most. In the figures above, we normalized all data to be quarterly (the most frequent time series offered by Cambridge Associates). Based on 101 quarters of available data, 90.1% of Global PERE’s are positive, compared to 68.3% for stocks.

Is private equity real estate

a good diversifier?

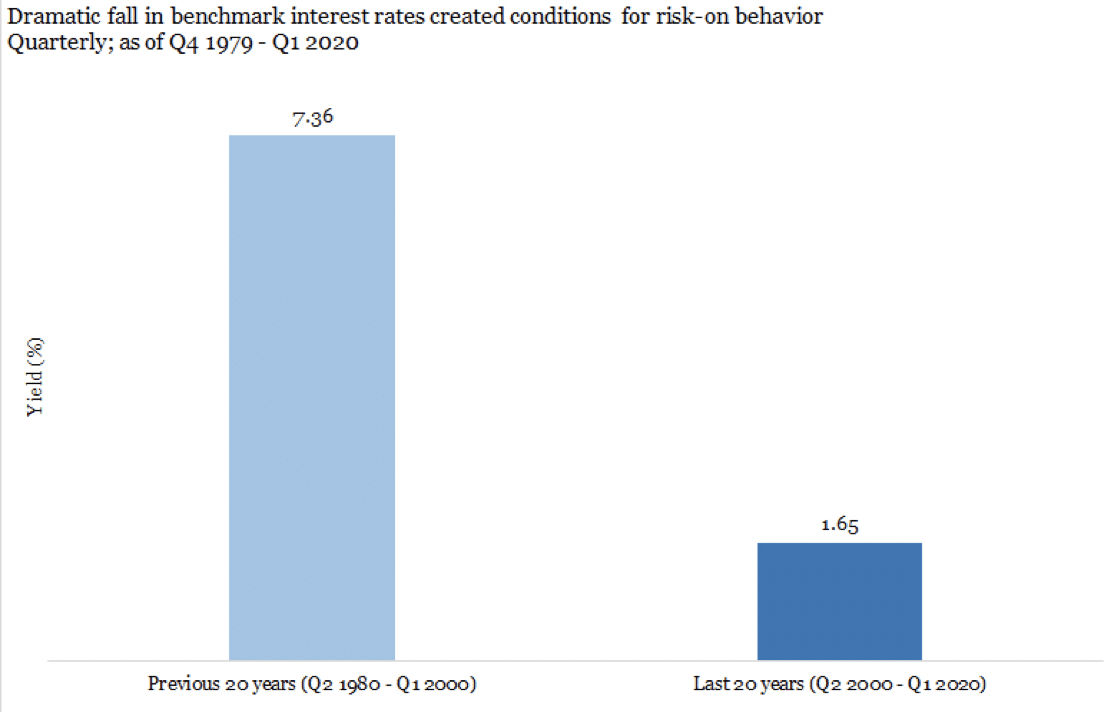

We believe the search for yield has created consistent demand for private real estate. As real yields have fallen precipitously, investors have been forced to replace the high returns/low-risk profile that government and corporate bonds’ previously offered. For example, consider the Effective Fed Funds rate over the last 40 years.

The significant drop in the average benchmark interest rate encourages risk-on behavior across the economy, and real estate is no exception. It’s no secret that real estate development is easier when interest rates are cheap. Pair availability of inexpensive debt with rising property values, and there is potential for robust returns.

Some combination of low interest rates and central bank-driven liquidity increased the correlation of key diversifiers to general market conditions following 2008. Correlation measures the linear relationship of two variables: higher correlation means a tighter relationship, lower correlation means a looser relationship. Optimally, a good diversifier exhibits high returns, low volatility and little correlation to your portfolio’s core systematic risk, typically represented by the S&P 500 Index.

Dividend stocks’ correlation remained mostly unchanged, dropping slightly from 79% to 77%. Both Global PERE and Equity REITs saw their correlation to the US Stock Market fall in the 10 years after Q1 2009 – 39% to 21% for REITs and 56% to just 11% for Global PERE! Divergent performance can explain the lower correlation; however, given Global PERE’s strong returns over the last few decades, we know that’s not the case. Lower correlation also means the investment is less susceptible to changes in the market environment. For example, Global PERE was unaffected during the DotCom Bubble, whereas dividend stocks and REITs lost -18.9% and -8.6%, respectively. The repackaging of subprime mortgages by financial institutions was the root cause of 2008’s recession. Both stocks and real estate suffered as a result. However, Global PERE demonstrated some resilience during the coronavirus sell-off in March: Global PERE only dipped -6.8% in a quarter where US stocks lost -16.5%. This time around, real estate was the victim rather than the villain.

Is private equity real estate a hedge for inflation?

The US Federal Reserve has two mandates: full employment and stable prices (otherwise known as keeping inflation under control). For decades, the Fed has targeted a 2% inflation rate by throttling interest rates up or down in response to changes in market conditions.

This summer, Chairman of the Federal Reserve Jerome Powell announced the central bank will allow inflation to run higher than 2% for longer before increasing interest rates. Inflation currently sits at 1.4%, as of September 2020.

Inflation represents a salient risk for older Americans approaching or already in retirement. A general rise in the price level of goods and services erodes your spending power. For instance, if a savings account yields 1% and inflation is 2%, your spending power drops by -1%. Given that many savings accounts pay less than 1% with no indication that benchmark rates will increase in the next few years, the prospect of higher inflation and lower yields signals a clear push by central banks to encourage investors to move cash into more speculative assets.

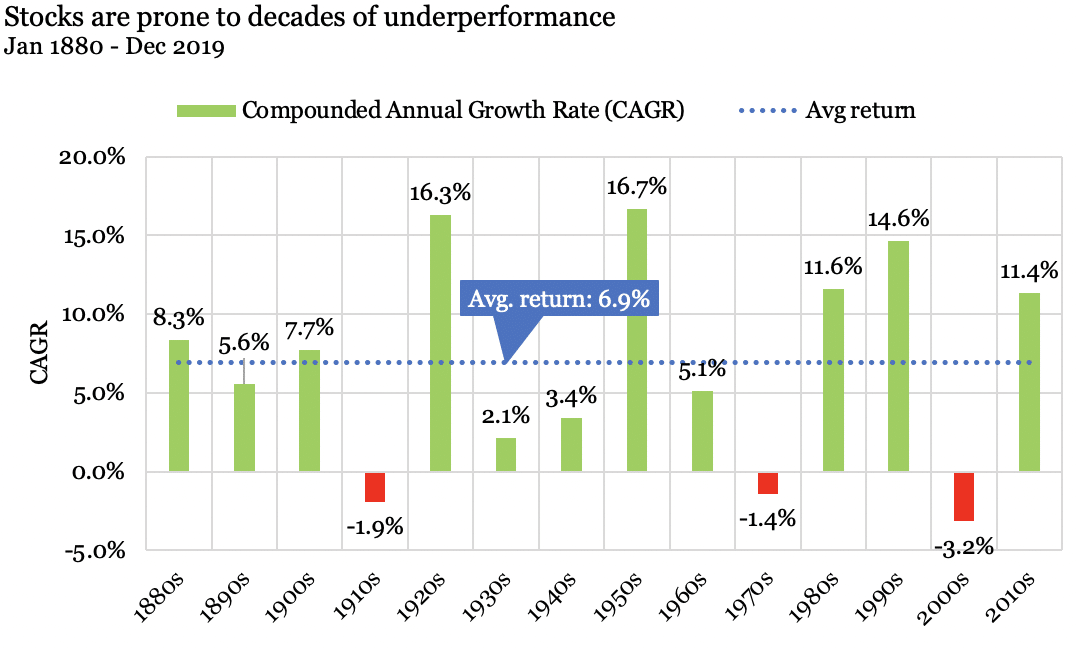

You can hedge inflation by investing in assets expected to maintain or increase their value over a specified period. While stocks and real estate are both considered effective ways to hedge inflation, we believe real estate is the stronger choice. While past performance is no indication of future results, stocks’ historical performance is something of a mixed bag, whereas a rise in inflation historically corresponds with an increase in property values and rents.

Despite a long-term compounded annual growth rate (CAGR) of nearly 7%, US stocks are prone to long periods of underperformance. For example, in the 14 decades of available data, stocks underperformed the long-term average and produced negative 10-year returns three times—and the most recent slump in the 2000s was worse than the Great Depression.

Unfortunately, the same sort of long-term historical data isn’t available for private real estate. We have a record of the prices at which high-quality commercial real estate transactions are currently being negotiated and contracted that dates to 1997, which generally supports the relationship between prices and inflation.

Conclusion

Publicly-traded stocks have earned a spot in a growth and income-oriented portfolio, based on their historical results. However, given current valuations and record-low interest rates, it may make sense to consider trimming the allocation in favor of private real estate. With the prospect of higher-than-normal inflation looming, growth and income investors may find more attractive opportunities in the less volatile and less correlated real estate market.

About Caliber

Caliber provides alternative access to individual and institutional investors via well-structured, private equity real estate investments in projects that we either develop or manage or bot

To invest in real estate and learn more, contact us today.