In the coming years, women are expected to control more wealth than ever before—a sea change that’s worthy of careful attention from the women at the heart of this dynamic shift as well as financial professionals aiming to serve this burgeoning clientele.

A critical inflection point

According to an analysis by McKinsey, women currently control about 30% of US household financial assets, totaling more than $10 trillion.[1] By 2030, that figure is expected to have grown by a factor of 3x or more.

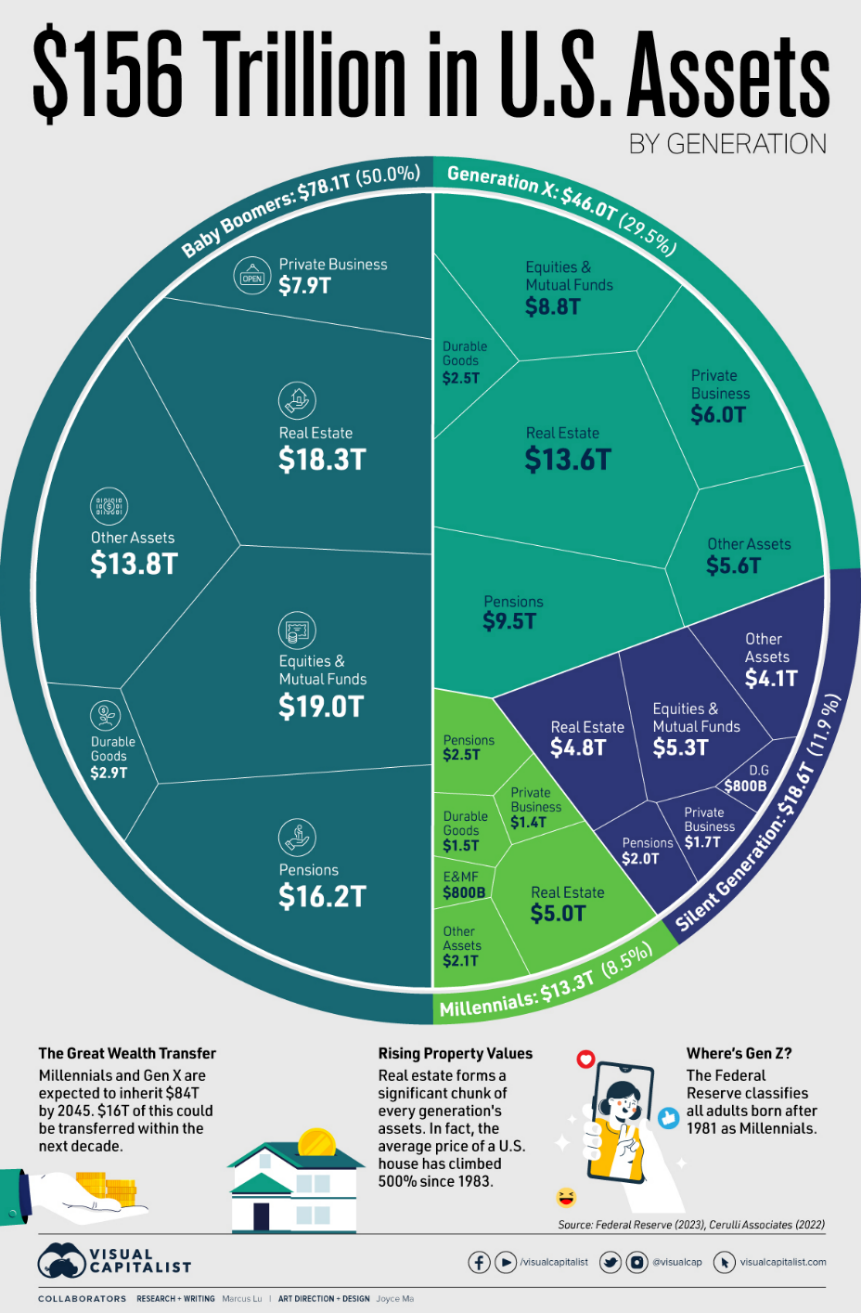

What’s driving this impressive growth? Demographics. Right now, aging baby boomers control about half of all US wealth—but women have longer life expectancies than men, so many women will soon end up managing wealth after their spouses or partners pass away. Boomers are also transferring wealth to the millennial generation, where women are expected to end up with a significant share.

Beyond generational wealth transfers, American women are accumulating more economic power in general. They’re starting more businesses, making more household financial decisions, and becoming breadwinners.[2]

Together, these catalysts are fueling a seismic shift in how wealth is managed in the US.

Gender wealth gap vs. wage gap

Most Americans are familiar with the gender wage gap, whereby women earn about 84 cents to the dollar of men.[3] But the wealth gap is much larger—and it arguably has farther-reaching implications, given wealth is a more holistic measure than wages. According to the Federal Reserve Bank of St. Louis, families headed by women have 55 cents in median wealth to every dollar owned by families headed by men. Gaps are even more pronounced when considering race/ethnicity and marital status.[4]

How women can position themselves for success

For women expecting to manage greater wealth in the coming years, preparation is critical. Experts recommend that women start today by:

- Thinking proactively about assets and financial goals

- Key questions: When do you plan to retire? Do you have dependents to support? Do you have goals around paying off debt, covering the cost of healthcare, or passing on multigenerational wealth?

- Considering their approach toward wealth management

- Key questions: What are your views on impact investing? Will you pursue philanthropy or charitable giving?

- Getting a team together

- Key question: How could you benefit from the expertise and guidance of a financial advisor, lawyer, or accountant?

Considerations for advisors and other financial professionals

Simply put, women manage wealth differently than men. To retain boomer women and acquire younger women, financial services providers need to rethink how they meet the differentiated needs and preferences of female clients. This demands a multifaceted, multiyear effort which often involves an evolution in business and service models. As a massive amount of money shifts into the hands of women, winning service providers will likely be those who can help women confidently navigate their newfound wealth and chart a path to financial freedom.

At Caliber, we create strategic investments that build generational wealth for our investors, community, and team. Caliber delivers a full suite of alternative investments to high net worth, accredited and qualified investors, as well as family offices and smaller institutions. We provide educational resources and an established business platform to a growing community of investor-customers, allowing entry to the often inaccessible world of private alternative investments. Contact us to learn more.

[1] “Women as the next wave of growth in US wealth management,” Pooneh Baghai, Olivia Howard, Lakshmi Prakash, and Jill Zucker, McKinsey & Company, July 2020, https://www.mckinsey.com/industries/financial-services/our-insights/women-as-the-next-wave-of-growth-in-us-wealth-management

[2] “The wealth transfer from baby boomers mostly benefits women,” Brittany Shammas, The Washington Post, January 16, 2024, https://www.washingtonpost.com/business/2024/01/16/women-economic-power-demographic-shifts

[3] Female-to-male earnings ratio, “Equal Pay Day: March 12, 2024,” United States Census Bureau, https://www.census.gov/newsroom/stories/equal-pay-day.html

[4] “Gender Wealth Gaps in the U.S. and Benefits of Closing Them,” Ana Hernandez Kent, Federal Reserve Bank of St. Louis, September 29, 2021, https://www.stlouisfed.org/open-vault/2021/september/gender-wealth-gaps-us-benefits-of-closing-them

About Caliber (CaliberCos Inc.) (NASDAQ: CWD)

With more than $2.9 billion of managed assets, including estimated costs to complete assets under development, Caliber’s 16-year track record of managing and developing real estate is built on a singular goal: make money in all market conditions. Our growth is fueled by our performance and our competitive advantage: we invest in projects, strategies, and geographies that global real estate institutions do not. Integral to our competitive advantage is our in-house shared services group, which offers Caliber greater control over our real estate and visibility to future investment opportunities. There are multiple ways to participate in Caliber’s success: invest in Nasdaq-listed CaliberCos Inc. and/or invest directly in our Private Funds.

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.

| 637-CAL-032024 |