A Featured Article From The Mesa Tribune on Caliber’s Commons of Mesa Multi-Family Asset

Click here to read the full article on The Mesa Tribune.

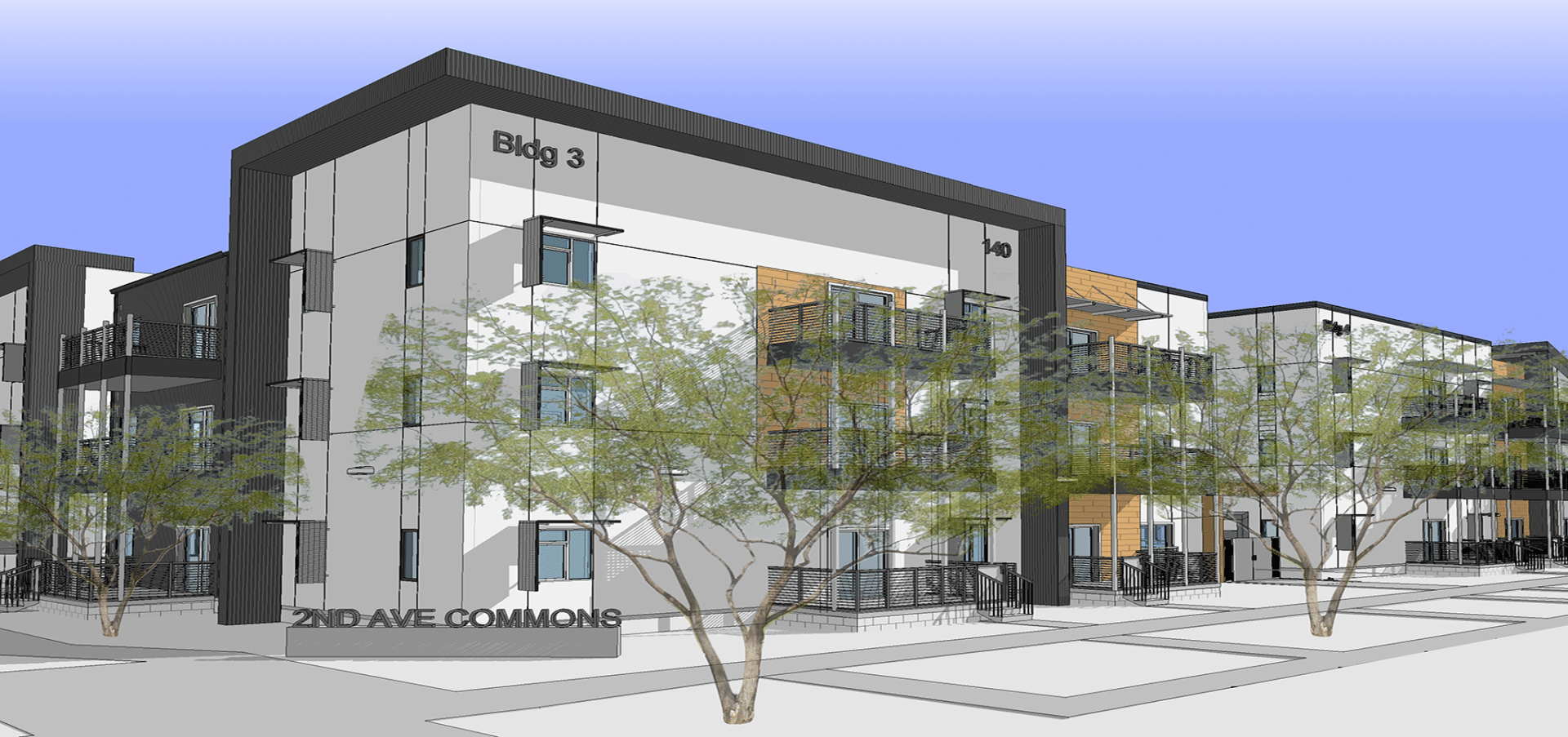

Another new housing project is coming to downtown Mesa.

Located on a 2.54-acre lot spanning 2nd Avenue between S. Robson and S. MacDonald streets, The Commons of Mesa will comprise 12 three-story buildings with 144 residential units, a pool, dog park and outdoor gathering spaces.

With monthly rent anticipated to range between $1,235 and $1,935, CaliberCos Inc. describes the units as “affordable workforce quality housing at a reasonable price.” The buildings will contain 48 one-bedroom and 96 two-bedroom apartments.

“We are proud that Caliber’s Opportunity Zone Fund is leading the effort to redevelop Downtown Mesa,” said John Hartman, the company’s chief investment officer. “This will further attract residents and workers to the downtown area.”

Caliber, a vertically integrated alternative asset manager and fund sponsor, began acquiring properties in and around downtown Mesa in 2017 and owns 20% of the frontage on Main Street.

The Scottsdale firm runs a number of investment funds – including one focused solely on properties located within opportunity zones.

Essentially, opportunity zones allow individuals to temporarily defer taxes on capital gains and potentially avoid taxes on new gains if they invest capital gains in specific areas approved by states and the federal government. Often those areas have been considered under-developed or run-down and in need of some government help of some kind to spur investment in them.

If a qualified investment is held for five years, there is a 10 percent exclusion of deferred gain. That goes up to 15 percent if the investment is held for seven years, according to the IRS.

“Selecting winning opportunity zone projects requires much more than a discerning eye and reliance on the federal program’s tax advantages. It requires careful strategy,” explained Caliber CFO Jade Leung.

He said the company considers regional growth and future potential, population trends, workforce pool, access to public transportation and healthcare facilities and that it works closely with local governments to identify needs.

Caliber’s investment in Mesa’s opportunity zone includes 10 vintage 1940s buildings totaling 160,000 square feet that are being refurbished for local tenants with diverse types of businesses, including a farmers’ market, butcher, bakery, wine sales, small booths and restaurants.

Click here to read the full article on The Mesa Tribune.

Click here to read our Commons of Mesa multi-family real estate asset announcement. Email us at [email protected] to learn more about this investment opportunity today.

Are you interested in learning more about Caliber’s private equity real estate (PERE) funds? Fill out the form below and we’ll contact you as soon as possible to discuss with you our offerings and their potential investment benefits.

About Caliber

Caliber – the Wealth Development Company – is a middle-market alternative asset manager and fund sponsor with approximately $2 billion in assets under management and development. The Company sponsors private funds and private syndications. It conducts substantially all business through CaliberCos, Inc., a vertically integrated asset manager delivering services which include capital formation and management, real estate development, construction management, acquisitions and sales. Caliber delivers a full suite of alternative investments to a $4 trillion market that includes high net worth, accredited and qualified investors, as well as family offices and smaller institutions. This strategy allows the Company to opportunistically compete in an evolving middle-market arena for alternative investments. Additional information can be found at CaliberCo.com and CaliberFunds.co.

Click here to see Caliber’s current property portfolio.

If you would like to speak to someone about diversifying your retirement accounts, contact us at [email protected] or call (480) 295-7600 to schedule a call with a member of our Wealth Development Team.

If you would like to learn more about Opportunity Zone Investing, Caliber has put together a special guide that cuts through the myths and misconceptions and outlines the benefits, the risks, and the upcoming deadlines you must know to be able to participate. Get access to the guide here.

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.