Investment success metrics play a crucial role in evaluating and measuring the performance of investment portfolios. As investors, it’s important to consider the returns on our investments and assess the associated risks and measure the effectiveness of our investment strategies. By utilizing performance measurement tools and analyzing return on investment, we can make informed decisions to maximize our investment success. We will explore key metrics such as compounded annualized growth rate (CAGR), volatility, Sharpe ratio, max drawdown, and alpha. Using these metrics, we will evaluate the performance of the Vanguard Real Estate Fund ETF (VNQ) as a reference point, providing insights into risk-adjusted returns and historical performance. By understanding these investment success metrics, we can make more informed decisions and enhance our investment outcomes.

How do you measure an investment’s results? Sure, returns are important, but what about the risk you may need to take to potentially realize those returns? In publicly-traded investments like stocks and bonds, there are some straightforward risk measures we can use to put an investment’s returns into context and, in doing so, make a more informed decision about the investment.

We will use the Vanguard Real Estate Fund ETF (ticker: VNQ) as our point of reference for this exercise. VNQ has a long track record (inception date 2004), has one of the lowest expense ratios in the real estate category at 0.12%, and is broadly diversified among US-listed REITs, making it a reasonable proxy for publicly traded REITs.

We should note that we’re citing VNQ for educational purposes, that Caliber isn’t affiliated with Vanguard, and that any mention of any security does not constitute a recommendation or solicitation to invest.

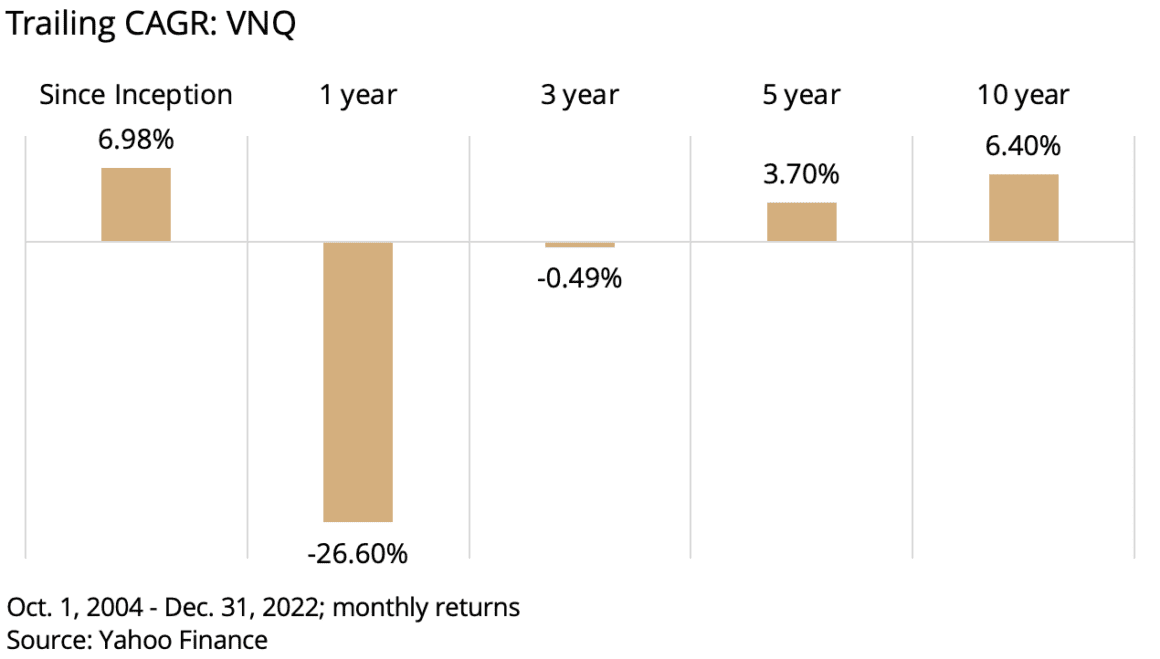

We’ll start by measuring the fund’s compounded annualized growth rate (CAGR), which considers the compounding effect of returns between Point A and Point B. Since inception, VNQ has produced a CAGR of 6.98% per year for nearly 20 years (Oct. 1, 2004 – Dec. 31, 2022), a reasonable rate of return over this period. It is worth calling out that CAGR assumes that you buy VNQ in the first very month it’s available for investment and then never sell – not always easy.

Commonly, CAGR is reported over several trailing time frames, often the last 1, 3, 5, and 10 years. The idea is to give you a rough approximation of what you may have earned, depending on when you bought it.

Here’s how VNQ has fared over different trailing periods:

In other words, if you had bought and held since inception, you would have earned 6.98%; had you bought one year ago, your returns would be -26.60%; returns over the past three years have been about flat at -0.49%, and so on.

The dispersion in returns is one of the drawbacks of CAGR: it doesn’t consider the volatility of returns and is very dependent on your choice of start date. The 1-year number looks very negative because it’s calculating returns from Dec 2021 (a good year) through Dec 2022 (a tough year). It’s why it’s generally a good idea to think about investments over more than one year, as you can see how the longer hold times generally reward investor patience with stronger compounded returns.

Volatility is the surest test of an investor’s patience. Volatility – more technically known as standard deviation – is the dispersion of returns away from the mean. Higher volatility investments are often harder to hold through their ups and downs and as a result, are usually considered riskier relative to a similar investment with lower volatility.

Logically, you’d want to know how volatile an investment has been in the past and judge that against its return. Optimally, we want something that generates the highest return at the lowest volatility. Fortunately, economist and Nobel laureate William Sharpe developed a ratio (that now bears his name) that compares the return earned by an investment against the volatility an investor would have had to stomach to achieve that return.

Sharpe ratio is a common way to measure an investment’s risk-adjusted returns. It’s fairly simple to calculate: subtract the investment’s return from the risk-free rate, then divide that figure by its standard deviation.

Let’s compare VNQ’s Sharpe ratio to iShares Core S&P 500 ETF (IVV) and Core US Aggregate Bond ETF (AGG). IVV and AGG are reasonable proxies for US large-cap stocks and the US bond market.

| Oct. 1, 2004 – Dec. 31, 2022 | Vanguard Real Estate (VNQ) | iShares Core S&P 500 ETF (IVV) | iShares Core US Agg. Bond ETF (AGG) |

|---|---|---|---|

| CAGR | 6.98% | 9.08% | 2.80% |

| Volatility (std. dev.) | 22.77% | 15.18% | 4.17% |

| Sharpe (1% RF) | 0.26 | 0.53 | 0.43 |

| Source: Yahoo Finance |

VNQ’s Sharpe is 0.26, meaning VNQ can be said to have “compensated” its investors with 0.26 units of return for every 1% of volatility you had to experience. That’s lower than IVV or AGG’s Sharpe Ratio due to the other funds’ lower volatility. Note that AGG’s Sharpe is higher than VNQ’s, even though it has lower returns.

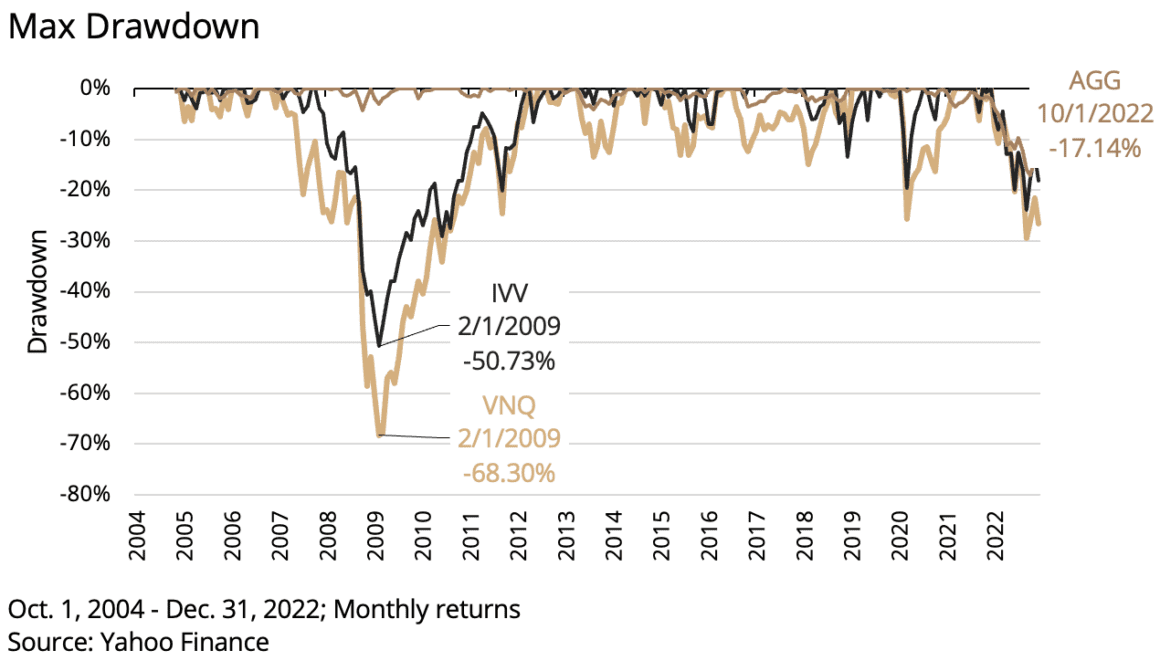

To recap: we use CAGR to find an investment’s compounded rate of return, volatility to understand how much that investment has moved around, and Sharpe ratio to compare the two. Now, let’s look at something called max drawdown, which tells us how much an investment has lost from peak to trough.

Max drawdown refers to the maximum decline or loss experienced by an investment or portfolio from its peak value to its lowest point before recovering. Max drawdown helps assess the potential risk and volatility associated with an investment. It provides an understanding of the worst-case scenario or the extent of losses an investment has experienced.

Let’s compare VNQ’s max drawdown to IVV and AGG’s:

| Oct. 1, 2004 – Dec. 31, 2022 | Vanguard Real Estate (VNQ) | iShares Core S&P 500 ETF (IVV) | iShares Core US Agg. Bond ETF (AGG) |

|---|---|---|---|

| CAGR | 6.98% | 9.08% | 2.80% |

| Volatility (std. dev.) | 22.77% | 15.18% | 4.17% |

| Sharpe (1% RF) | 0.26 | 0.53 | 0.43 |

| Max drawdown | -68.30% | -50.73% | -17.14% |

| Source: Yahoo Finance |

Max drawdown tells us that VNQ’s “worst case scenario” loss is -68.3%, worse than IVV’s and AGG’s.

By visualizing max drawdown for more than one investment, we can compare when the max drawdown occurred to see if the losses came simultaneously. IVV and VNQ both saw their worst-case loss occur during the 2009 global financial crisis; given that the collapse of the subprime mortgage industry served as one of the catalysts for that recession, IVV and VNQ’s run of underperformance during this period isn’t surprising. Note that AGG’s max drawdown occurred at a different period from IVV and VNQ. Why? As a bond fund, AGG’s returns depend far more on underlying interest rates than on investor sentiment.

We use “alpha” to measure whether an investment can produce returns different from a given benchmark. You’ll get one of two definitions of alpha, depending on who you ask. The first definition is simply excess returns: subtract Fund A’s return minus Fund B’s; if Fund A’s returns are higher than Fund B’s, then Fund A can be said to have generated “alpha.”

The second, more technical definition comes from the Capital Asset Pricing Model (CAPM), a financial model that establishes the relationship between the expected return of an investment and its systematic risk. Systematic risk is a risk that an investor cannot mitigate through diversification. When calculating CAPM, the Greek letter “beta” represents systematic risk.

The CAPM helps determine the expected return that investors should demand from an investment based on its level of risk, as measured by beta. The model suggests that an investment’s expected return should increase with its beta, reflecting the additional compensation required for taking on systematic risk.

In the context of CAPM, alpha represents the unexplained or abnormal return that cannot be attributed to the systematic risk captured by beta.

| Oct. 1, 2004 – Dec. 31, 2022 | Vanguard Real Estate (VNQ) | iShares Core S&P 500 ETF (IVV) | iShares Core US Agg. Bond ETF (AGG) |

|---|---|---|---|

| CAGR | 6.98% | 9.08% | 2.80% |

| Volatility (std. dev.) | 22.77% | 15.18% | 4.17% |

| Sharpe (1% RF) | 0.26 | 0.53 | 0.43 |

| Max drawdown | -68.30% | -50.73% | -17.14% |

| Beta (to IVV) | 1.11 | 1.00 | 0.05 |

| Alpha (to IVV) | -3.10% | 0.00 | 8.95% |

| Source: Yahoo Finance |

A beta greater than 1.00 indicates that the investment tends to be more volatile or fluctuate more than the overall market. In other words, the investment is expected to have a higher level of systematic risk compared to the market as a whole.

Here’s what different beta values generally imply:

- Beta = 0: The investment has no correlation with the market. Its returns are unrelated to the overall market movements.

- Beta < 1.00: The investment is expected to be less volatile than the market. It tends to experience smaller fluctuations compared to the overall market.

- Beta = 1.00: The investment is expected to move in line with the market. It has a similar level of volatility or systematic risk as the overall market.

- Beta > 1.00: The investment is expected to be more volatile than the market. It tends to experience larger price swings compared to the overall market.

VNQ has a beta of 1.11, which implies that, on average, the fund is expected to move 11% more than the overall market. So if the market goes up by 1%, VNQ could be expected to increase by approximately 1.11%. Conversely, AGG has a beta of 0.05, meaning it is almost zero correlation with the market.

Accounting for beta, VNQ’s produced negative -3.10% alpha relative to IVV since inception. That means that it has underperformed relative to the expected return predicted by the CAPM, given its systematic risk (beta) and the market return. That’s not surprising, given that VNQ isn’t managed to generate alpha, only to capture the beta of the publicly traded REIT market.

By considering CAGR, volatility, Sharpe ratio, max drawdown, beta, and alpha, investors can better understand an investment’s historical performance, risk profile, and potential alignment with their investment objectives. It is important to evaluate multiple factors and metrics when making investment decisions and to conduct further research and analysis specific to individual investment needs and circumstances.

About CaliberCos Inc.

CWith more than $2.9 billion of managed assets, Caliber’s 15-year track record of managing and developing real estate is built on a singular goal: make money in all market conditions. Our growth is fueled by our performance and our competitive advantage: we invest in projects, strategies, and geographies that global real estate institutions do not. Integral to our competitive advantage is our in-house shared services group, which offers Caliber greater control over our real estate and visibility to future investment opportunities. There are multiple ways to participate in Caliber’s success: you can invest in Nasdaq-listed CaliberCos Inc. and/or you can invest directly in our Private Funds.

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.

422-CAL-062723