During the third week of January, certified public accountants (CPAs) gathered at Caliber – The Wealth Development Company’s offices to help attendees understand opportunity zone funds and the recently updated regulations that supplement the program.

Caliber’s director of tax Coulson Painter and tax manager Scott Mills started the event by running over the basic details of the program.

Designed to increase business activity and economic investment in distressed areas, the Opportunity Zone initiative allows eligible taxpayers to receive preferential tax treatment when investing into a designated OZ tract, Painter explained.

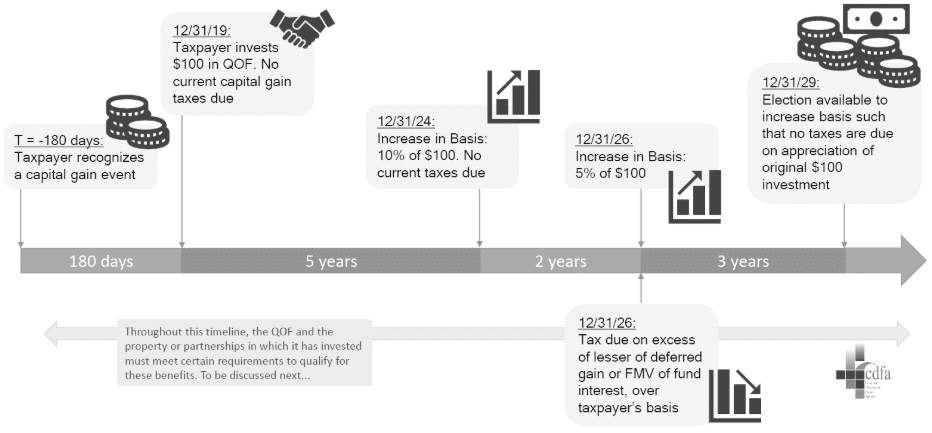

One way that investors receive this tax benefit is by having their capital gains deferred until the investment is sold, or by December 31, 2026, whichever comes first. Over time, the deferred gain is reduced. Additionally, investors can benefit by having their gains permanently excluded from appreciation of investment.

Painter also explained why timing your investment is an important aspect of the program and can help investments reach their full potential.

If fund managers choose to sell the investment after five years, 100% of the gain will be deferred. If the investment is held for more than five years but less than seven years, 90% of the gain will be deferred. If the investment is held for more than seven years, 85% of the gain will be deferred. Investments held for at least ten years are permanently excluded from capital income.

Another topic was the final regulations update that happened in December of 2019.

The final rules provide more clarity regarding new opportunity zone investments and also specify the types of gains that qualify for investments or that can be excluded from tax after a 10-year holding period.

To learn more about these specifications, view the recorded CPA event here or refer to the video at the top of the page.