Join Chris Loeffler, Caliber CEO, as he shares Caliber’s journey from a small startup to a market leader in commercial real estate asset management and gives key insights on Caliber’s innovative investment approach, including self-directed IRAs and private loans.

There are various approaches utilized by Caliber, such as converting commercial spaces, investing in distressed real estate, and introducing pickleball facilities. In this podcast, Chris discusses the importance and intricacies of approaching opportunity, building investor trust, securing funding, transitioning to the public domain, and maximizing returns within Opportunity Zones.

To download a copy of the slides used in this presentation, click the link below!

https://drive.google.com/file/d/1518oD2pBjn9tAVN5v5MAS7CE5oFNWtE7/view?usp=sharing

Additional Resources:

There are many seasoned investors and advisors who misunderstand critical aspects of Opportunity Zone Investing.

We’ve put together a unique guide to help you educate yourself and avoid some of the common misconceptions:

Click here to get access to “The Accredited Investor’s Guide To Opportunity Zone Investing” today.

If you are ready to speak with a senior member of our Wealth Development team, contact us today to schedule a call.

Important: Investments in Caliber private placements can lose entire value, are illiquid, and are speculative. Refer to the Amended and Restated Private Placement Memorandum (PPM) for a more detailed discussion of risk factors.

By the time musician Glenn Campbell “gets to Phoenix,” after The Monkees “miss the last train to Clarksdale,” and Ol’ Blue Eyes “wakes up in a city that never sleeps,” more than 120,000 people have already passed through Phoenix Sky Harbor Airport, one of the nation’s busiest at nearly 45 million each year.

In fact the lively and sprawling international hub has become such an integral part of life and doing business in Phoenix that many can’t envision a time without its four terminals and amazing highway and light rail connectivity. Being just three miles from downtown Phoenix and adjacent to the Papago Park and Phoenix Zoo area, Old Town Scottsdale, Tempe’s Mill Avenue, Arizona State University, and other important centers of commerce and cultural attractions, many consider Sky Harbor the heartbeat of the Valley and clearly the main point of entry for visitors.

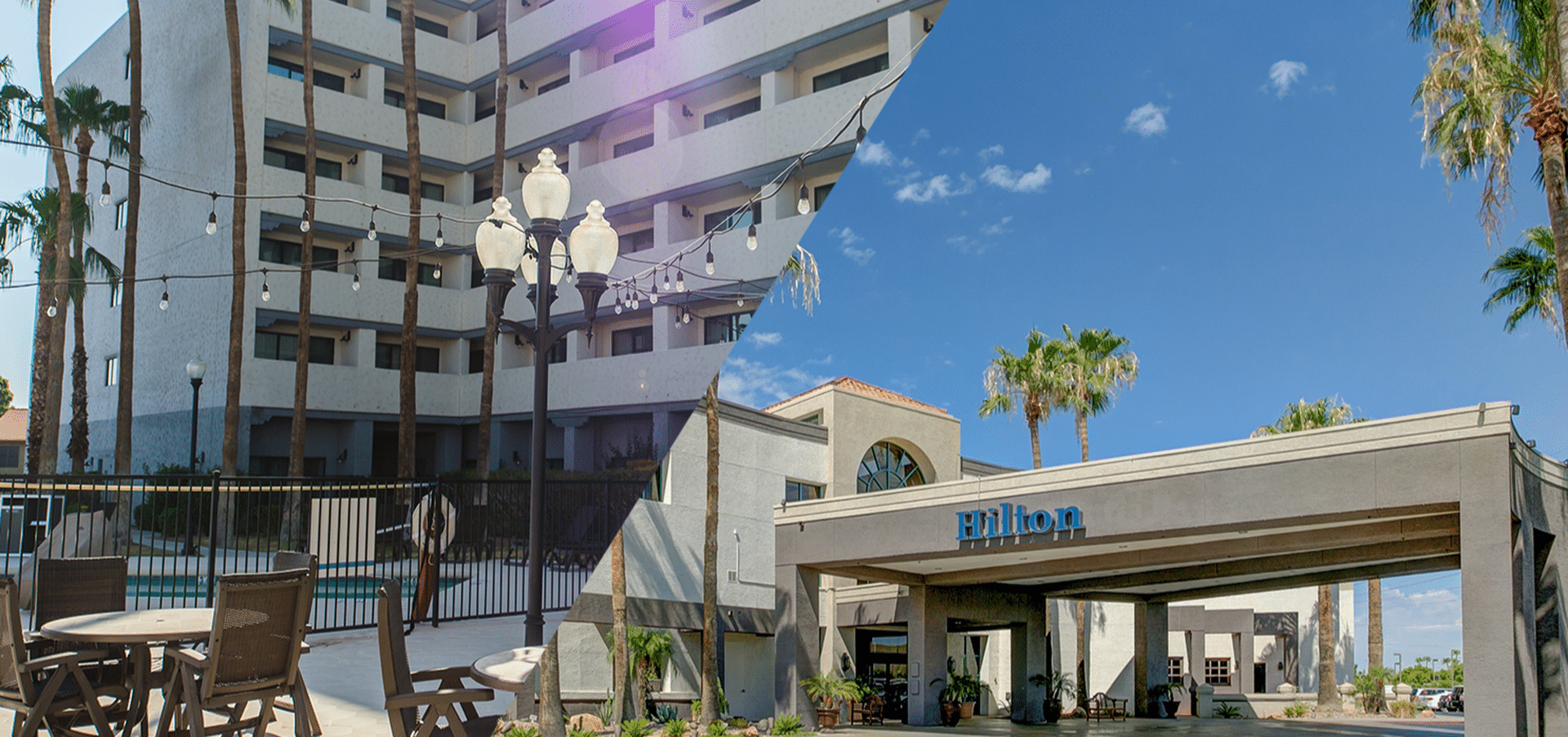

So it made perfect sense when Caliber – The Wealth Development Company made investments in two redevelopment hotel projects near Sky Harbor that now net hefty profits. Both are located within the new Federal Opportunity Zones where new investment in distressed areas receive preferred tax treatment. The company also has a third property in the works.

One of these investments, the 290-room Crowne Plaza Phoenix Airport, located just two minutes from Sky Harbor, was literally rebuilt from the ground up after Caliber purchased the distressed property in 2012 for $5.5 million. It didn’t take long for the company’s expert team to invest more than $18 million in renovations, upgrade the hotel sales and management teams, and turn the property around, which now consistently ranks in the top 20 in quality among 212 other Crowne Plaza Hotels worldwide.

The other Sky Harbor area acquisition, Hilton Phoenix Airport, occurred in November 2016 after the building was fully remodeled. Again, the underperforming 259-room property needed the Caliber touch. After managing the property and significantly reducing its operating costs, Caliber was able to boost the hotel’s annualized net operating income and improve the overall bottom line for investors.

Caliber’s good work caught the eye of Scott Turner, the Executive Director of the White House Opportunity and Revitalization Council, who visited the Phoenix area in May. He toured a few select Opportunity Zones and Caliber projects, including the grassy spot where Caliber plans to build the 95-room Phoenix Avid hotel.

“To see projects that are actually moving, to see tools being utilized, a platform being utilized, dirt moving and projects coming in a pipeline and not just ideas. Ideas are awesome, but these ideas are coming to fruition, and that’s very encouraging to me,” Turner enthusiastically told Caliber executives during the tour.

Opportunity Zones are just that; an opportunity to rebuild and re-instill a sense of pride in once-blighted communities, to create jobs, and generate an opportunity for investors to roll over capital gains into a tax-free vehicle.

So, instead of “meeting me in St. Louis,” as Judy Garland famously crooned, maybe we should visit Sky Harbor.