Caliber is capitalizing on record-high prices and has sold 331 units since the beginning of 2021. Despite selling the units, Caliber remains active in multi-family apartments and other commercial real estate sectors.

Roy Bade has seen a lot of highs and lows over the past 40 years in the sometimes boom-or-bust Arizona real estate market.

During that time, Bade has worked in brokerage, construction and development. Since 2014, Bade has been at Scottsdale, Arizona-based asset manager and fund sponsor Caliber Cos. sourcing and analyzing potential properties, seeking ways to maximize returns on existing assets and managing construction and development activities.

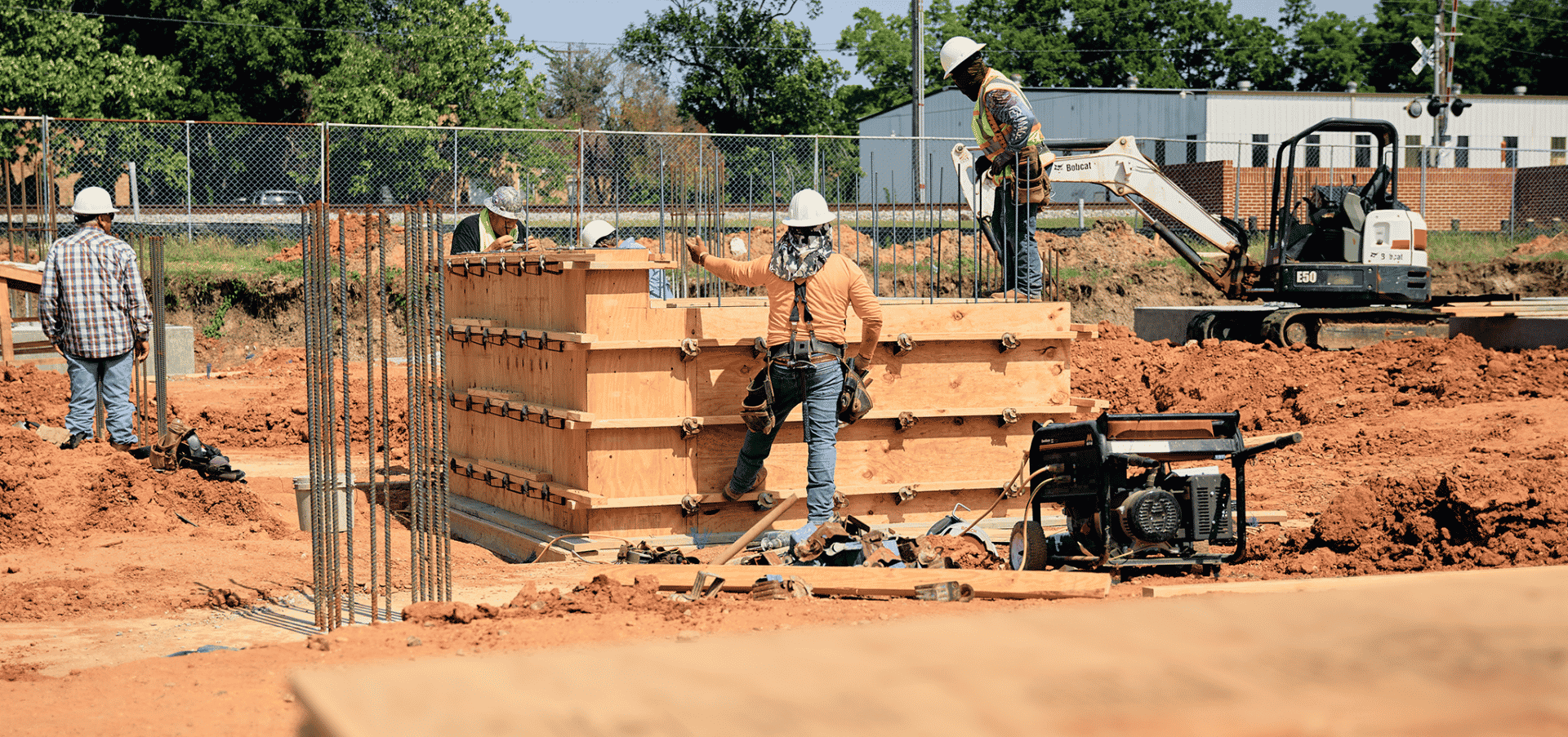

For Bade, Caliber’s chief development officer, the past couple of years have been extremely busy. There is a building boom in Arizona, and the company is an active participant with 334 apartment units and townhomes either built over the past five years or in the pipeline.

“We normally look at a product with a five-year lifespan at a minimum.“We have [properties in] ‘opportunity zones’ [a federal program providing tax benefits for building in low-income census tracts]. So we get a 10-year lifespan.”

Roy Bade – Chief Construction Officer

Interview with Roy

MULTIFAMILY DIVE: On the construction side of the business, how are you dealing with supply chain and labor issues?

ROY BADE: One of the ways that we’re working to mitigate supply chain and labor challenges is by working with highly successful partners and other top-tier companies in the industry.

When we partner with people that have been bringing in the best talent for a number of years, to begin with, it also helps with the supply chain issues. If you’re working with partners at top-tier companies, they normally have excellent relationships with the supply chain partners who they work with along the way.

We also aren’t afraid to change course, if we need to. We’re always working with our partners. We generally have weekly meetings to talk about what’s working in the supply chain, what’s not and how to pivot.

MULTIFAMILY DIVE: You have sold 331 units since the beginning of 2021. Are you sensing we’re at the top of the market for valuations?

Join Chris Loeffler, Caliber CEO, as he shares Caliber’s journey from a small startup to a market leader in commercial real estate asset management and gives key insights on Caliber’s innovative investment approach, including self-directed IRAs and private loans.

There are various approaches utilized by Caliber, such as converting commercial spaces, investing in distressed real estate, and introducing pickleball facilities. In this podcast, Chris discusses the importance and intricacies of approaching opportunity, building investor trust, securing funding, transitioning to the public domain, and maximizing returns within Opportunity Zones.

To download a copy of the slides used in this presentation, click the link below!

https://drive.google.com/file/d/1518oD2pBjn9tAVN5v5MAS7CE5oFNWtE7/view?usp=sharing

Additional Resources:

There are many seasoned investors and advisors who misunderstand critical aspects of Opportunity Zone Investing.

We’ve put together a unique guide to help you educate yourself and avoid some of the common misconceptions:

Click here to get access to “The Accredited Investor’s Guide To Opportunity Zone Investing” today.

If you are ready to speak with a senior member of our Wealth Development team, contact us today to schedule a call.

Important: Investments in Caliber private placements can lose entire value, are illiquid, and are speculative. Refer to the Amended and Restated Private Placement Memorandum (PPM) for a more detailed discussion of risk factors.

About Caliber

Caliber – the Wealth Development Company – is a middle-market alternative asset manager and fund sponsor with approximately $2 billion in assets under management and development. The Company sponsors private funds and private syndications. It conducts substantially all business through CaliberCos Inc., a vertically integrated asset manager delivering services which include capital formation and management, real estate development, construction management, acquisitions and sales. Caliber delivers a full suite of alternative investments to a $4 trillion market that includes high net worth, accredited and qualified investors, as well as family offices and smaller institutions. This strategy allows the Company to opportunistically compete in an evolving middle-market arena for alternative investments. Additional information can be found at CaliberCo.com and CaliberFunds.co.

CONTACTS:

Caliber:

Victoria Rotondo

+1 480-295-7600

[email protected]

Media Relations:

Kelly McAndrew

Financial Profiles

+1 203-613-1552

[email protected]

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.

| 098-CAL-062422 |