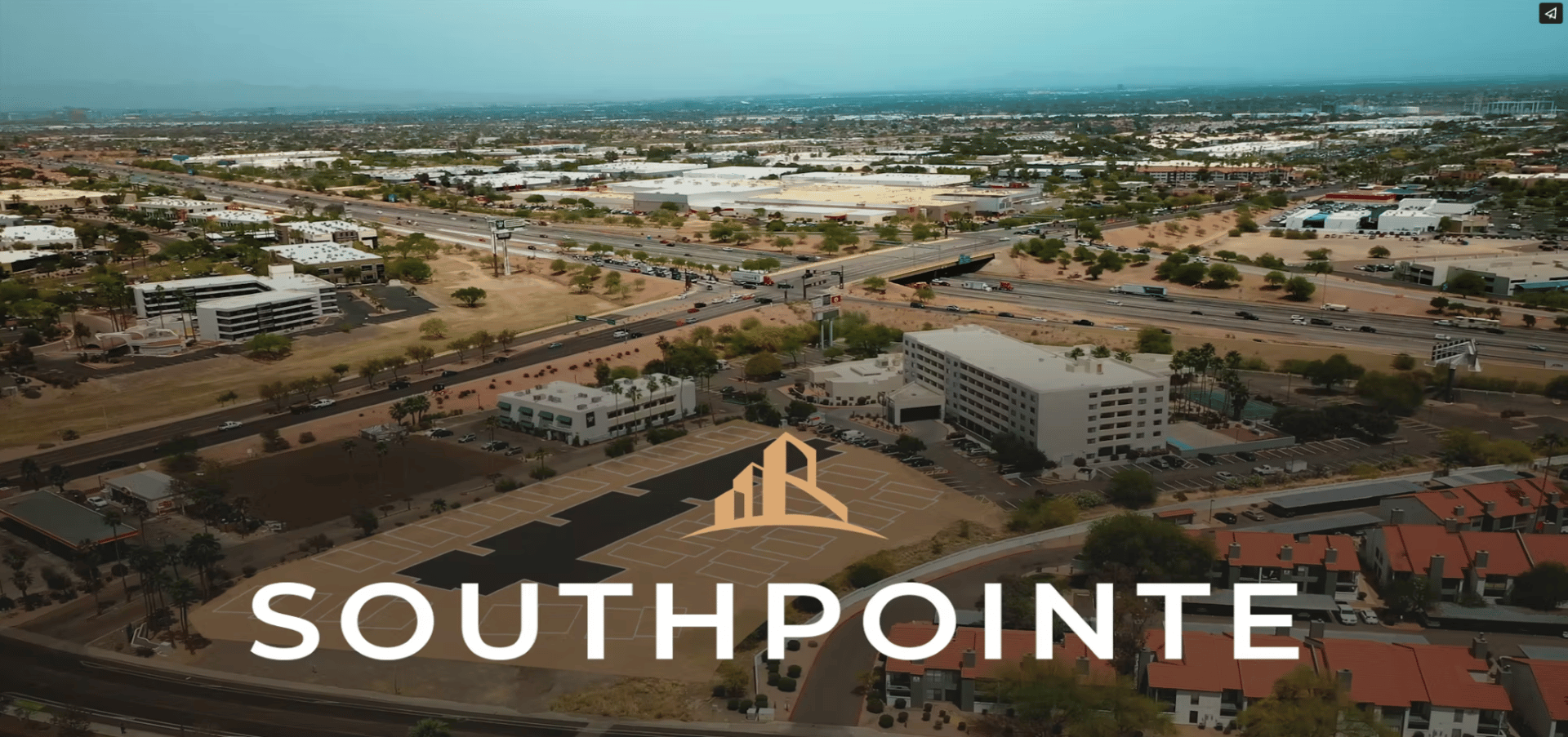

The Southpointe land (Parcel 1) purchase includes ±2.93 acres located southwest of Elliot Road and Interstate 10 in Phoenix, Arizona. The acquisition closed in June and Caliber is processing a development that will include 51 low-density, multi-family units.

The property is a highly sought-after, residential parcel located in the greater-Phoenix area, one of the strongest housing markets in the U.S. Investors participating in this fund will generate quarterly income from the notes offering.

The adjacent hotel property (Parcel 2), which is not a part of this current offering, is an existing hotel that will be repurposed into a multi-family for rent project, which will be operated as a joint project along with the Parcel 1 development described above. The hotel redevelopment will also include 44 ground-level units. Upon completion of the two developments, in total will include 195 units, which will be called SouthPointe.

If you want to learn more about this investment opportunity, please fill out the form below to access the webinar and/or you can contact us at [email protected], or reach out to your designated Wealth Development Team representative for next steps.

Join Chris Loeffler, Caliber CEO, as he shares Caliber’s journey from a small startup to a market leader in commercial real estate asset management and gives key insights on Caliber’s innovative investment approach, including self-directed IRAs and private loans.

There are various approaches utilized by Caliber, such as converting commercial spaces, investing in distressed real estate, and introducing pickleball facilities. In this podcast, Chris discusses the importance and intricacies of approaching opportunity, building investor trust, securing funding, transitioning to the public domain, and maximizing returns within Opportunity Zones.

To download a copy of the slides used in this presentation, click the link below!

https://drive.google.com/file/d/1518oD2pBjn9tAVN5v5MAS7CE5oFNWtE7/view?usp=sharing

Additional Resources:

There are many seasoned investors and advisors who misunderstand critical aspects of Opportunity Zone Investing.

We’ve put together a unique guide to help you educate yourself and avoid some of the common misconceptions:

Click here to get access to “The Accredited Investor’s Guide To Opportunity Zone Investing” today.

If you are ready to speak with a senior member of our Wealth Development team, contact us today to schedule a call.

Important: Investments in Caliber private placements can lose entire value, are illiquid, and are speculative. Refer to the Amended and Restated Private Placement Memorandum (PPM) for a more detailed discussion of risk factors.

About Caliber

Caliber – the Wealth Development Company – is a middle-market alternative asset manager and fund sponsor with approximately $1.5 billion in assets under management and development. The Company sponsors private funds and private syndications. It conducts substantially all business through CaliberCos, Inc., a vertically integrated asset manager delivering services that include capital formation and management, real estate development, construction management, acquisitions and sales. Caliber delivers a full suite of alternative investments to a $4 trillion market that includes high net worth, accredited and qualified investors, as well as family offices and smaller institutions. This strategy allows the Company to opportunistically compete in an evolving middle-market arena for alternative investments. Additional information can be found at CaliberCo.com and CaliberFunds.co.

Click here to see Caliber’s current property portfolio.

If you would like to speak to someone about diversifying your retirement accounts, contact us at [email protected] or call (480) 295-7600 to schedule a call with a member of our Wealth Development Team.

If you would like to learn more about Opportunity Zone Investing, Caliber has put together a special guide that cuts through the myths and misconceptions and outlines the benefits, the risks, and the upcoming deadlines you must know to be able to participate. Get access to the guide here.

Investor Considerations

The information contained herein is general in nature and is not intended, and should not be construed, as accounting, financial, investment, legal, or tax advice, or opinion, in each instance provided by Caliber or any of its affiliates, agents, or representatives. The reader is cautioned that this material may not be applicable to, or suitable for, the reader’s specific circumstances, desires, needs, and requires consideration of all applicable facts and circumstances. The reader understands and acknowledges that, prior to taking any action relating to this material, the reader (i) has been encouraged to rely upon the advice of the reader’s accounting, financial, investment, legal, and tax advisers with respect to the accounting, financial, investment, legal, tax, and other considerations relating to this material, (ii) is not relying upon Caliber or any of its affiliates, agents, employees, managers, members, or representatives for accounting, financial, investment, legal, tax, or business advice, and (iii) has sought independent accounting, financial, investment, legal, tax, and business advice relating to this material. Caliber, and each of its affiliates, agents, employees, managers, members, and representatives assumes no obligation to inform the reader of any change in the law or other factors that could affect the information contained herein.

| 106-CAL-062922 |